Overnight pharmaceutical giant Eli Lilly surged 9.5% after posting better-than-expected earnings and raising its full-year outlook on strong demand for diabetes treatment Mounjaro and obesity drug Zepbound – a massive move for a $US800bn business. LLY reported 2nd quarter revenue that significantly outstripped expectations, plus they hiked the full-year revenue outlook by $3 billion. The drugmaker now expects revenue for the year to come in between $45.4 billion and $46.6 billion and full-year adjusted earnings to a range between $16.10 to $16.60, up from a previous guidance of $13.50 to $14 per share – there was nothing not to like in this result.

Demand has far outstripped supply for incretin drugs such as Zepbound and Mounjaro, which mimic hormones produced in the gut to suppress a person’s appetite and regulate their blood sugar. That has forced LLY and its Danish rival Novo Nordisk (NVO US) to invest heavily to boost manufacturing. However, LLY’s supply issues may be starting to ease. On Friday, the Food and Drug Administration’s drug database said all doses of Zepbound and Mounjaro are available in the U.S. after extended shortages. The company cautioned that expected increases in demand might result in periodic “supply tightness” for certain doses of its incretin drugs but overall, good problems to have. LLY expects incretin drug production in the second half of 2024 to be 50% higher than it was during the same period last year.

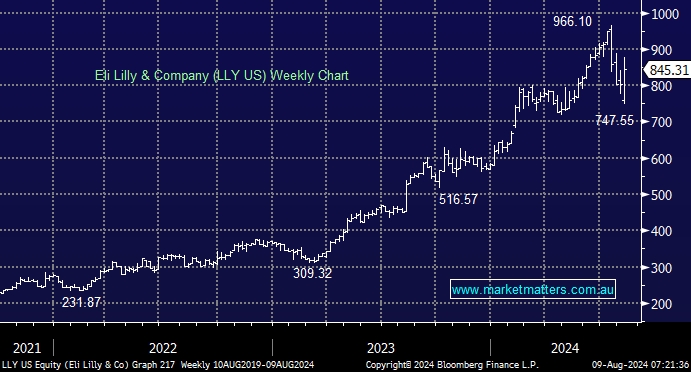

This has become an exciting company within the healthcare sector which we like into dips.

- We like the risk/reward of LLY, around $US800, and will monitor it for our International Companies Portfolio.