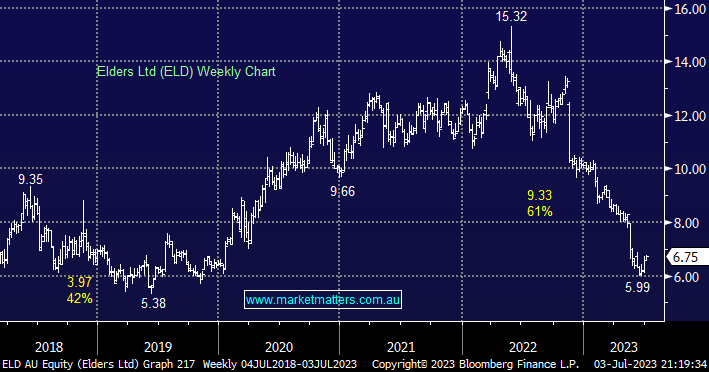

We discussed ELD in Saturday’s Q&A Report here with our main point being “We think many investors have capitulated, and the next 20-30% is more likely on the upside”. FY23 was a poor year for the rural service provider after announcing the retirement of the influential CEO before commencing a global search for a new leader, which was ultimately unsuccessful prompting Mark Allison to postpone his retirement. Continued pressure on earnings and uncertainty about leadership put pressure on the share price which more than halved.

Having been negative on ELD throughout FY23, and critical of the company’s messaging, we now believe the stock looks good here and is set for a better FY24. From an investment perspective, we would advocate keeping some powder in reserve in case it has one more foray down towards $6.

- We like the risk/reward towards ELD with an initial target in the $8-9 region.