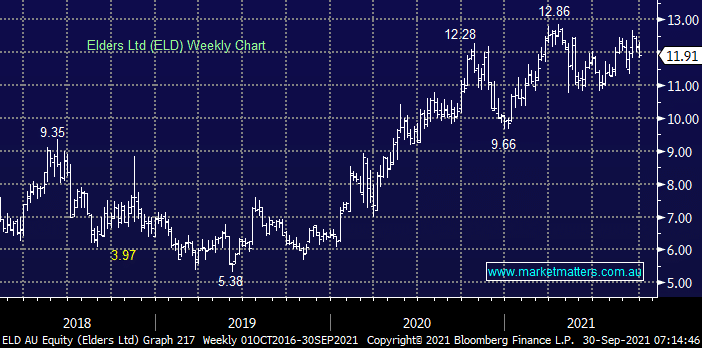

ELD’s comprehensive footprint covers farm & rural insurance, commodity exchanges, and property / farming equipment sales. Hence by definition ELD is a great proxy for the health of the Australian Agricultural Sector and not surprisingly this South Australian based company has enjoyed a strong few years where COVID was no more than a blip on the radar. We like this $1.8bn sector goliath which comes with the added bonus of a steady greater than 3% yield, the issue is price / valuation. We like ELD under $12 but its far more exciting below $11.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

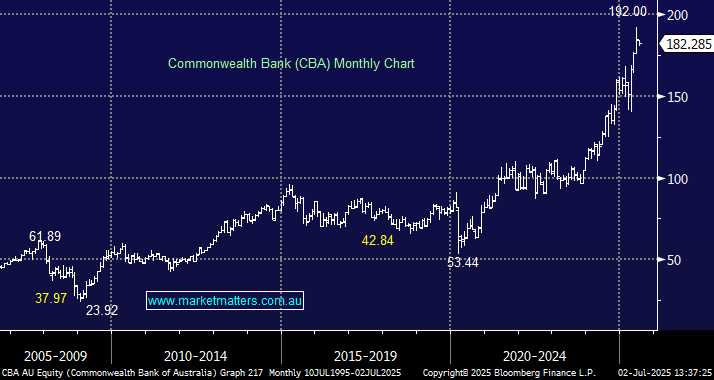

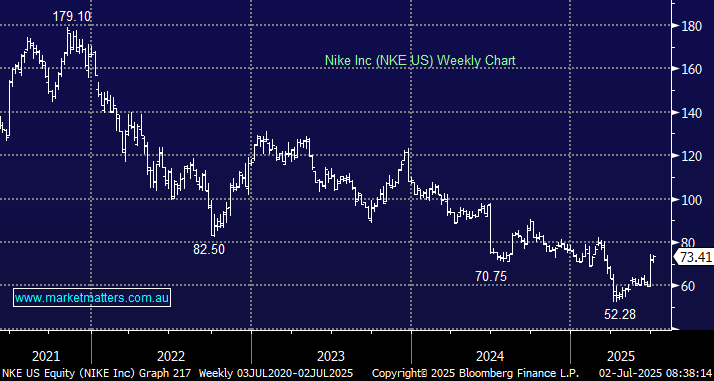

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

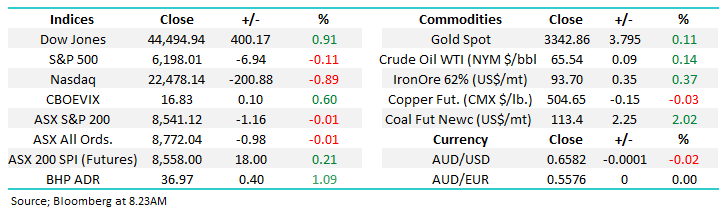

Wednesday 2nd July – Dow +400pts, SPI up +18pts

Wednesday 2nd July – Dow +400pts, SPI up +18pts

Close

Close

Tuesday 1st July – ASX +10pts, HMC, IFL, SGH

Tuesday 1st July – ASX +10pts, HMC, IFL, SGH

Close

Close

MM likes ELD into weakness

Add To Hit List

Related Q&A

Elders

Elders (ELD)

Does MM believe Elders (ELD) has seen a bottom?

Have Elders (ELD) shares hit the bottom?

MM’s thoughts on Elders (ELD) please

Which does MM prefer ELD or GNC?

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Wednesday 2nd July – Dow +400pts, SPI up +18pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Tuesday 1st July – ASX +10pts, HMC, IFL, SGH

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.