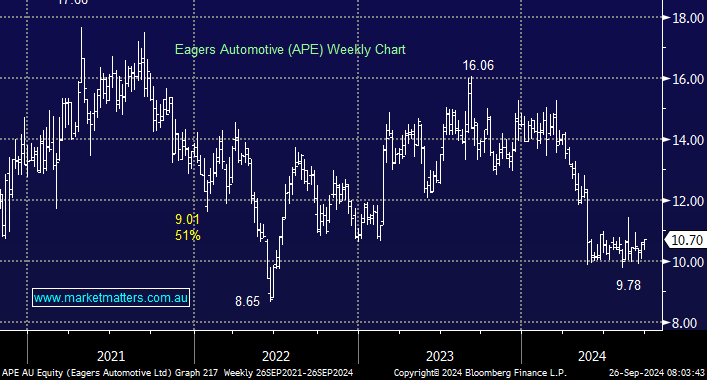

Extrapolating the equation mentioned earlier, increased liquidity creates more capacity to buy discretionary items. For example, a more confident and flush consumer is more likely to buy a new car after a period of lower activity in the space. APE is Australia’s largest car dealer, and after a tough 12-months, with the shares trading down 26% year-to-date, value is emerging – the stock is trading at a depressed multiple, around 25% cheap relative to history as the market continues to think an earnings recovery is some way off.

- They still have challenges, excess inventory needs to be worked through to ease margin pressure, but increased appetite could address this when Michele Bullock presses the cut button; it won’t just be property that benefits.

Their 1H24 result showed the business performing strongly considering the headwinds they’ve faced. We feel the risk/reward is improving rapidly as global interest rates fall, especially for the yield-hungry investor with some patience.

- We have APE in our Hitlist for the Active Income Portfolio, courtesy of its fully franked yield of just shy of 7%.