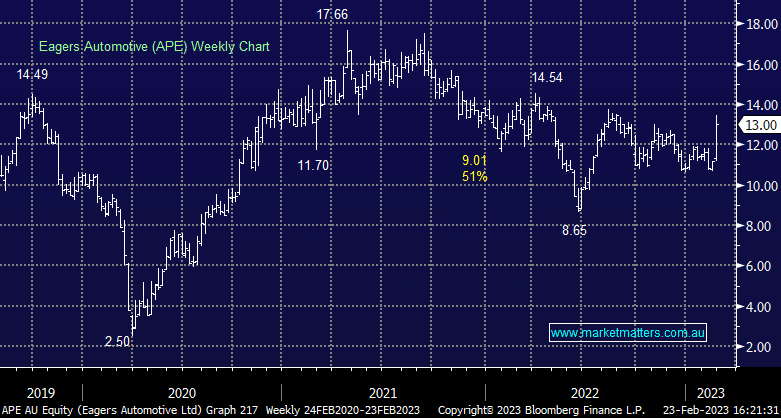

APE +8.97%: Topped the leader board today with FY22 results that met expectations while their guidance for FY23 was stronger than expected. Revenue of $8.54bn was largely inline with consensus while underlying profit before tax of $405m was around a 2% beat driven by better margins while the dividend of 71cps compared well to the 60cps expected. They talked a big game for the year ahead, guiding to $9.5-10b in sales in FY23, which is ~8% above where the market was. This strong result and positive commentary about the year ahead, we suspect will have also helped leasing & salary packaging business Smart Group (SIG) who reported an inline result today against some more negative market positioning. We have held both stocks in the past, with SIQ residing on our hitlist.

scroll

Question asked

Question asked

Question asked

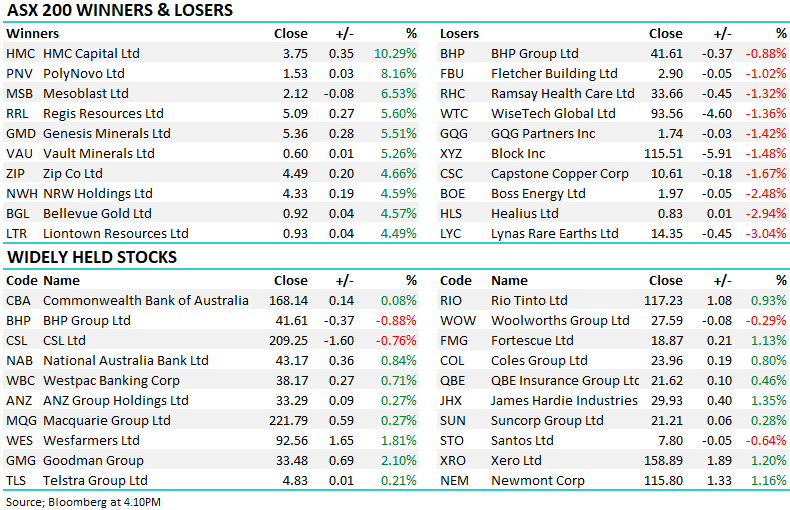

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

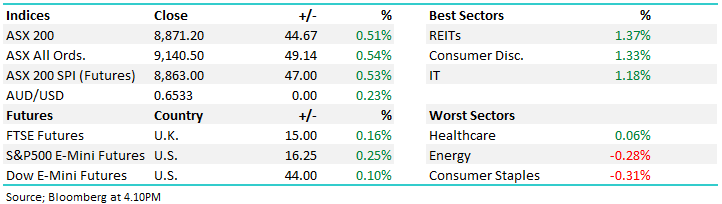

Thursday 4th September – Dow off -24pts, SPI up +31pts

Thursday 4th September – Dow off -24pts, SPI up +31pts

Close

Close

Wednesday 3rd September – Dow off -249pts, SPI down -37pts

Wednesday 3rd September – Dow off -249pts, SPI down -37pts

Close

Close

MM is neutral/bullish APE

Add To Hit List

Related Q&A

Income shares

What happened to Eagers (APE)?

What’s the best ‘car stock’ to buy?

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Thursday 4th September – Dow off -24pts, SPI up +31pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Wednesday 3rd September – Dow off -249pts, SPI down -37pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.