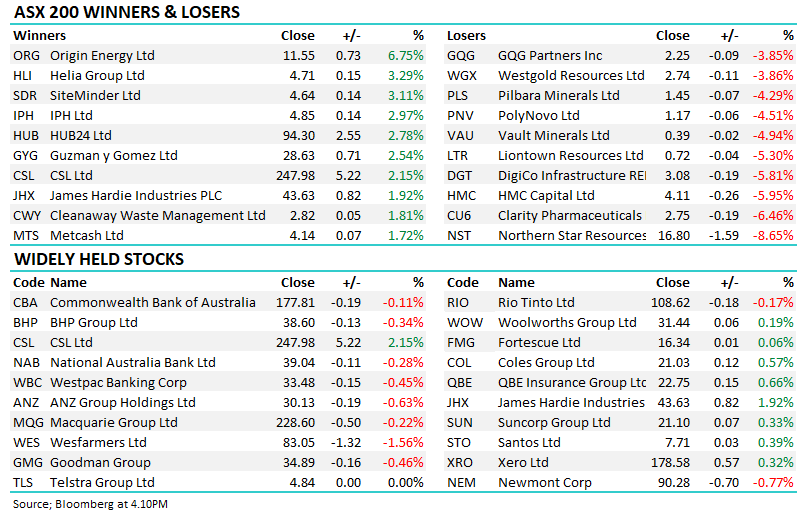

APE +3.31%: the Australian & NZ auto dealership company saw shares trade higher today after a strong first-half update. Underlying pre-tax profit is expected to come in around $195m, around 5% above guidance provided in May of $183-189m. The car market has been struggling to get its hands on supply, so Eagers now has a record new car order book while cost-out programs are further supporting earnings. They completed the sale of Bill Buckle Auto as expected on 30 June, adding another $83m to their pile of cash which now stands at $326m. This balance sheet strength supports plans to buy back 10% of shares on issue over the next 12 months.

scroll

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

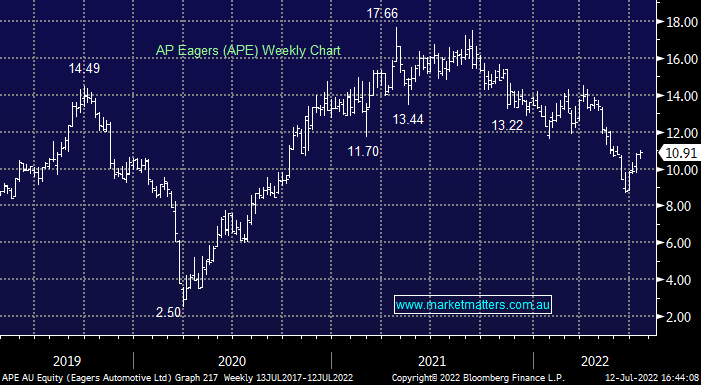

MM is bullish APE ~$11

Add To Hit List

Related Q&A

Income shares

What happened to Eagers (APE)?

What’s the best ‘car stock’ to buy?

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.