DGT was floated on the ASX in late 2024 when its was spun out of HMC Capital who still own 18.2% of the $1.8bn REIT – by definition HMC’s share price is partly correlated to that of DGT. While DigiCo is an established player in the DC space with 13 assets across Aus / the US, and plans for 238MW of datacentre capacity, its share price through 2025 is likely to be largely driven by risk valuations attributed to the sector.

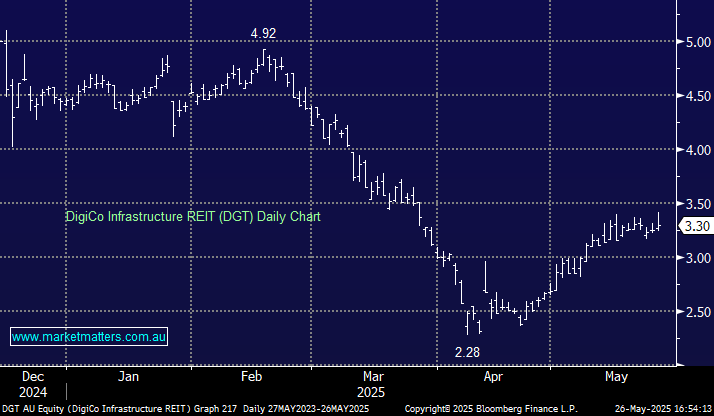

We were cautious on DGT when it IPO’d at $5, but it’s clearly representing more compelling value in the low $3’s. While this is not the quality of GMG or NXT, it screens well on a relative value basis.

- We like the risk/reward towards DGT in the $3-3.20 area.