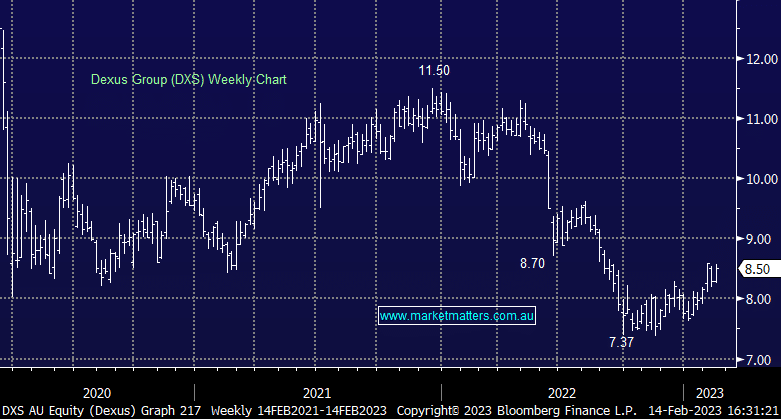

DXS +2.41%: A beat and bump today for the much-maligned office REIT, with 1H23 Funds From Operations (FFO) of $389m above consensus of $367m while they increased FY23 distribution guidance to be at the top end of the previously flagged range of 51-51.5c. Occupancy levels have held up in Office (95.3% versus 95.6% in FY22) and remain strong in Industrial (97.4%), gearing at 25.6% is below their targeted 30-40% range while external revaluations of property assets were fairly benign, resulting in a 27c or 2.2% decrease in net tangible asset (NTA) per security during the period, which sits at $12.01 as at 31 December – or ~40% above today’s closing price. Priced at an Est PE of 12.2x and yielding 6%, we are happy holders of DXS in our Active Income Portfolio.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

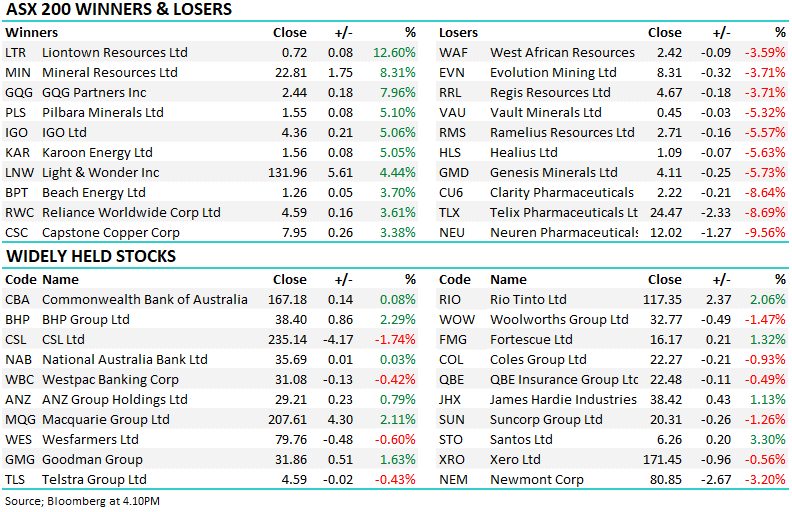

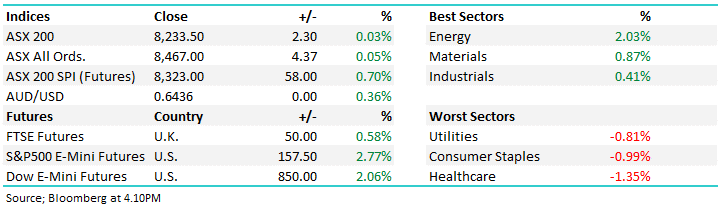

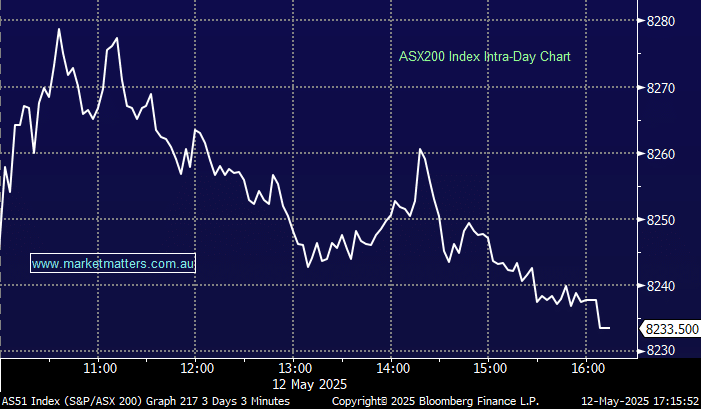

Monday 12th May – Dow down -119pts, SPI up +16pts

Monday 12th May – Dow down -119pts, SPI up +16pts

Close

Close

MM remains long & bullish DXS

Add To Hit List

Related Q&A

Undervalued REITS

How much further can real estate stocks appreciate?

Updated view on Dexus

Is Dexus (DXS) a buy?

MM updates on DXS, NSR and ABB

Which REITS have the most capital upside?

Property stocks

Thoughts on some property stocks please

Thoughts on property stocks DXS, CHC and GMG please

What are MM’s updated thoughts on Dexus (DXS)?

Talking Dexus (DXS)

Does Dexus (DXS) look cheap to MM?

How to play bond yields & real-estate stocks?

What stocks for property exposure?

Is Dexus (DXS) still a buy?

ACR, SCP & DXS

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Monday 12th May – Dow down -119pts, SPI up +16pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.