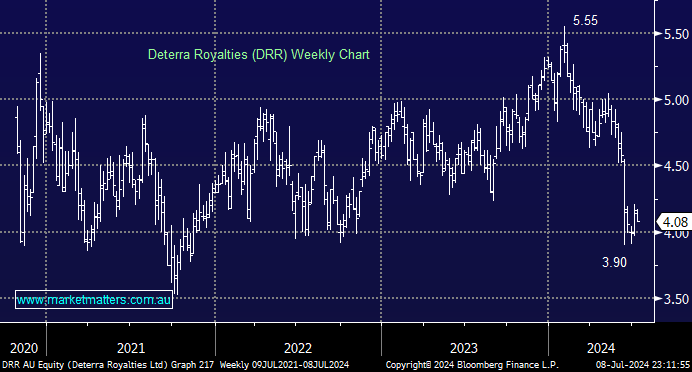

We didn’t like DRR’s recent bid for lithium royalty business Trident Royalties (TRR LN), and the market has reacted accordingly, driven by concerns over the changed dividend policy, i.e. the reason many investors held the stock has gone. However, we are starting to feel the market has overreacted and is neglecting the company’s core value, with 90% of DRR’s NAV and revenue still coming from the solid MAC royalty stream. The share price remains at the mercy of sentiment around iron ore, but DRR is starting to present value, especially if it spikes down to fresh 2024 lows.

- We see value returning to DRR if/when the stock makes new 2024 lows below $3.90.