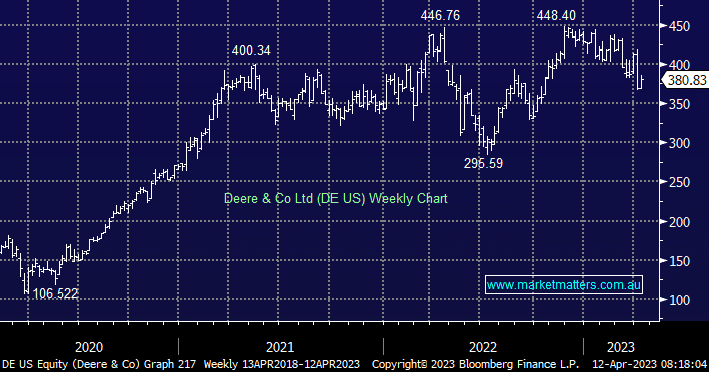

In February, John Deere provided a great quarterly update beating expectations and upgrading full-year earnings guidance – the stock popped and all looked very solid. More recently shares have come under pressure and our 6% holding bought at $US367 is now up only ~5%, having been up ~18% at its best, prompting the question, has something changed?

The short answer is yes, but not at the company level (yet). A string of weaker economic data points in the US has increased the chance of recession which is clearly being shown through bond markets – a theme we cover regularly, and as a result, the US Industrial sector has been hit more broadly. Makers of heavy equipment like Deere & Co are more sensitive to economic cycles than say Microsoft (MSFT US) on the belief that a slowing economy will reduce the demand for machinery, with Deere & Co the world’s biggest maker of farm equipment clearly in the cross hairs. We get another quarterly update from DE US on the 19th of May, and given the trend last quarter was very positive, we will give the position the benefit of the doubt for now, however, if there are signs of a slowdown, we will exit.

- DE US hit a new 5-month low last week as recessionary fears mount.