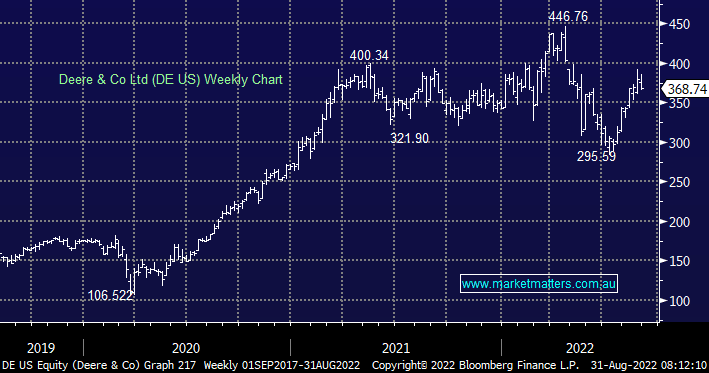

Australia is a small market and expanding our horizons to give subscribers access to true global players in different industries underpinned our decision to launch the Market Matters International Equities Portfolio midway through 2019. Since then the portfolio has returned 15.27% per annum targeting a high conviction portfolio of around 20 large-cap stocks. While Deere & Co have more than 25 brands, the green and yellow John Deere tractors are very much front and centre and is indicative of the type of stock we want to own in this portfolio i.e. true global companies we simply can’t get exposure to in Australia. Farm incomes have been strong driven by high crop prices and this drives demand for machinery, both large and small. While this ebbs and flows over time, we think their current Est P/E of 14.4x is not expensive given the outlook for double-digit earnings growth over the next two years.

scroll

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM remains long & bullish DE US

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.