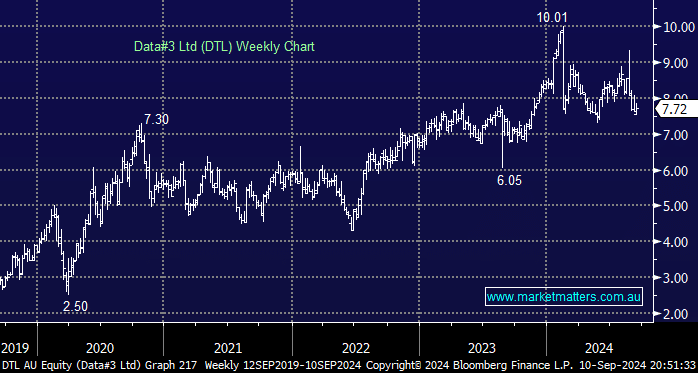

For those unfamiliar with $1.2bn QLD-based DTL, it’s a value-added reseller of software and infrastructure products to government and enterprise customers in Australia. According to the company, it was Microsoft, Cisco, and HP’s no.1 reseller in Australia and a top-five reseller for Dell in sales terms in FY23. DTL is a well-run business leveraged to increasing spend on IT; however, we see a few risks into FY25 which have contributed to the stock’s more than 20% pullback from its early 2024 high:

- The QLD government may trim spending and reduce the use of external consultants before October’s election, anything to win votes—the QLD government represents ~20% of DTL’s sales.

- DTL highlighted ongoing delays in IT spending decisions, which could lead to soft 2H sales across the board as companies/Govt. watch costs.

- Infrastructure sales in FY25 look questionable based on the decline in Cisco’s global networking sales, with Cisco making up 50-60% of DTL’s infrastructure sales.

Some areas outside of DTL’s control look set to determine DTL’s earnings in FY25, which is not appealing to MM. The QLD Government is looking to improve efficiency, and with ~55% of DTL’s sales coming from the whole Government sector, the company is at risk of other states following suit. We are sure there is plenty of “fat” in their operation that could be removed. Another important consideration when looking at DTL is how it stacks up against rival $1.6bn Dicker Data (DDR):

- We believe both DDR and DTL are solid businesses with durable moats, but DTL’s more defensive revenue and stronger balance sheet are why we believe it should trade on a higher valuation – which it does, but on 25x and some headwinds in FY25 we believe it’s too rich.

Slight margin declines will likely occur as software continues to outperform and DTL pursues higher-value but lower-margin contracts, offsetting growth in higher-margin Services. Microsoft’s Copilot (AI) rollout represents potential for upside for DTL. Overall, we believe DTL is a solid business with an appealing growth trajectory, but the near-term risks aren’t fully priced in, and the risk/reward isn’t attractive, close to $8.

- We wouldn’t be surprised to see DTL test below $7 into 2025.