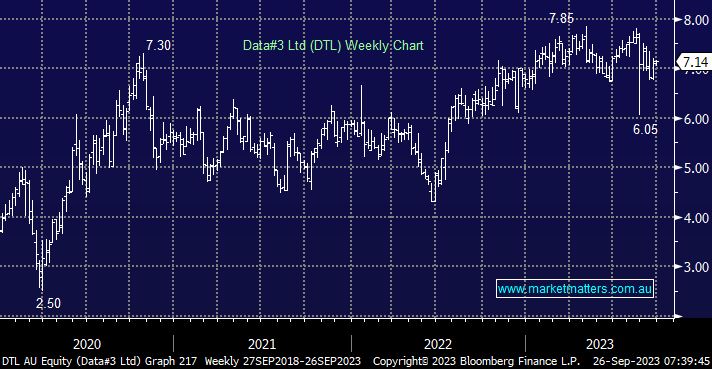

DTL is a $1.1bn IT business, which has been trading around $7 for most of 2023, Morgans recently downgraded the IT solutions company to a hold with the same $7 price target. We believe the company will be a benefactor of increased IT spending in areas such as IT services and cloud networking infrastructure over the years ahead. The stock looks good value, trading on a PE of 26.6x for 2024, plus an estimated 3.6% yield, with its outlook helped by its defensive government contracts.

- We like the outlook for DTL, but it may need a catalyst to break above $7.