The $US edged towards its 2023 high last week, and a mildly hawkish FOMC this week will likely see a test of 106. Similarly to US bond yields, it’s hard to comprehend any meaningful downside until US inflation drops back to 2% – in August, the CPI rose to 3.7% with gasoline prices the most attributable factor in the increase. Things are headed in the right direction after US inflation peaked above 9% in mid-2022, but often, the last few per cent of any exercise can prove the hardest.

- We are net bearish towards the $US, but the short-term bounce could last a touch longer, as has been the market’s nature through 2023.

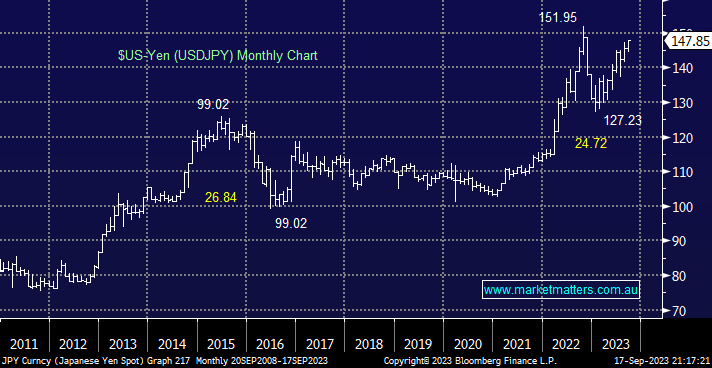

The Yen is again approaching multi-decade highs with the interest rate differential between the US and Japan driving the move i.e. earlier this month BOJ policymaker Hajime Takata ruled out an early exit from negative interest rates. However, we believe the advance by the $US-Yen is maturing on a medium/long term basis, and while a break to fresh decade highs feels like a coin toss, another -20% pullback won’t be far behind, in our view.

- We believe it’s prudent to wait for a macroeconomic catalyst before flagging it’s time to fade the Yen’s advance.