Crude oil has been on a roller coaster ride this month as traders tried to work out whether this time was different; they honed in on satellite images over Iran and Hormuz, where not only was there no disruption, but if anything, oil flows looked higher. Off the coast of Iran, each day, a steady flow of tankers were picking up the country’s barrels and sailing off into the ocean. While Tehran’s empty ships had scattered, likely for security reasons, Iran’s oil flowed about 40% higher than the average for the rest of the year. Today, traders have a massive amount of digital information at their disposal, from real-time satellite images to second-by-second “crowd reporting” on social media, a great example of why investors, not traders, should be conscious of price movements more than news headlines.

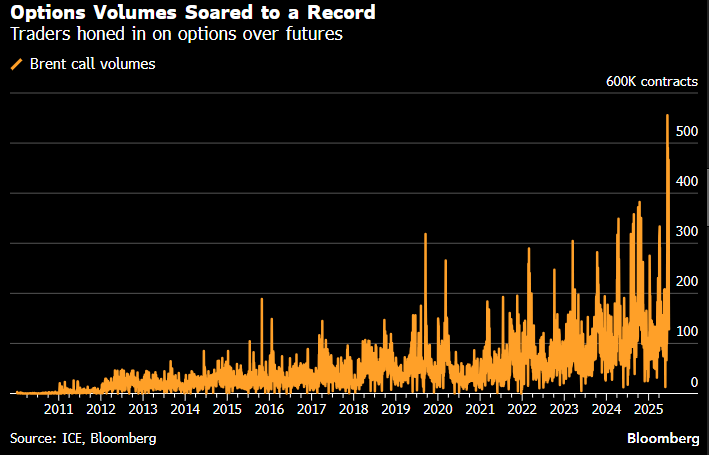

As the Middle East conflict evolved, trading crude futures suddenly became much riskier, and money poured into the options space, where traders can take out insurance against price spikes, both up and down. There, markets were moving so fast that traders and brokers constantly had to re-price deals as fresh headlines signalled escalation in the conflict, pushed volatility and the cost of buying such insurance ever higher. Record volumes of options changed hands, and the total amount traded over seven working days was the equivalent of what is commonly seen in several months. But a few weeks later and prices are largely unchanged:

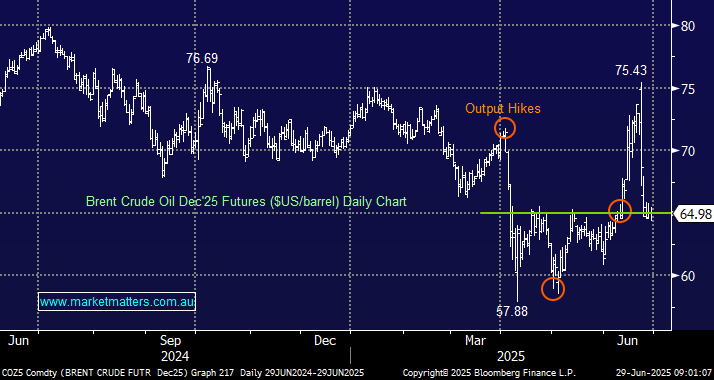

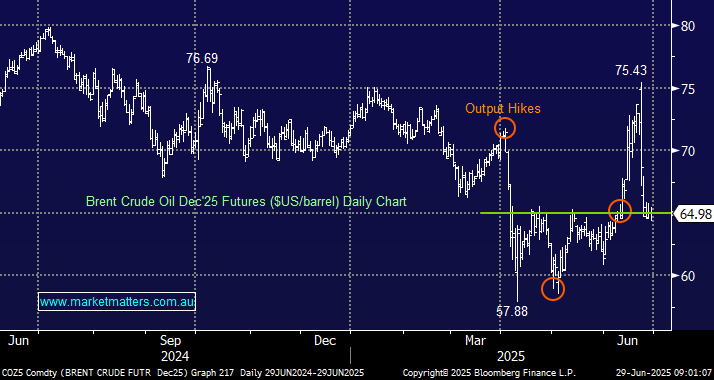

- We believe investors should avoid such noise and look at the bigger picture, which in this case shows that oil prices remain under pressure.

The past fortnight has provided clear evidence of the psychological shift that’s taken place in a market long haunted by memories of the dramatic price moves driven by Middle Eastern conflict in the 1970s and 1980s. Today’s markets are more resilient to news; instead, they focus on whether there will be a supply disruption, enabling them to concentrate on levels to start selling more often than not. Much like those in 1991, traders have spent the past two weeks wrestling with the prospect of the supply disruption that only happens once in a generation: an interruption to the Strait of Hormuz chokepoint that ships about a fifth of the world’s oil – while the answers no, crude will struggle to hold above $US70.

- We can see Brent Crude trading around US$65 this week as the dust and news flow abate around the Middle East conflict.