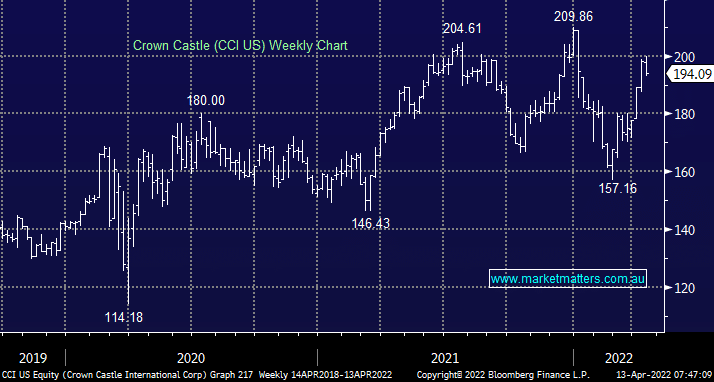

We’ve written a lot in recent times around our expectations/views towards transitioning portfolios into more defensive assets as the year progresses, and one such stock that caught our eye during the week following a subscriber question was US-listed Crown Castle. CCI is one of the largest providers of communications infrastructure in the US, operating large communication towers, fibre-optic cable networks along with a growing number of small cell wireless sites. This is critical infrastructure for 5G and while the bride will be upset I’m writing this, 5G is the future of telecommunications. This is an example of a long-duration asset with a decade-long pipeline for growth, stable and predictable earnings with upside potential through the ramp-up in 5G investment.

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM likes CCI into weakness

Add To Hit List

Related Q&A

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.