CPU is an almost 20bn business that makes money by charging companies fees to manage shareholder records and corporate actions, and by earning interest on large client cash balances it temporarily holds, hence making it a business that benefits from elevated interest rates. This is very much a global business with ~60% of its revenue generated in the US, hence if the Fed does cut rates aggressively, as the Trump administration would like, it’s not ideal for CPU. However, with CPU underperforming over the last 6-months, we believe the market is pricing in more rate cuts into CPU’s share price than the futures market implies, improving the risk/reward for the stock.

- In FY25 of CPU’s $US3.1bn revenue, around 24% came from interest earned on clients’ cash balances.

Global corporate actions have been strong, up 43% in 1Q26, led by a 116% jump in IPO activity, while M&A and secondary deals rose 41% and 42% respectively – highlighting that Computershare continues to benefit from a healthy equity market and trading environment. In terms of margin income, the outlook for aggressive rate cuts was a negative, though these have been tempered in recent weeks and we think negative surprises here are unlikely.

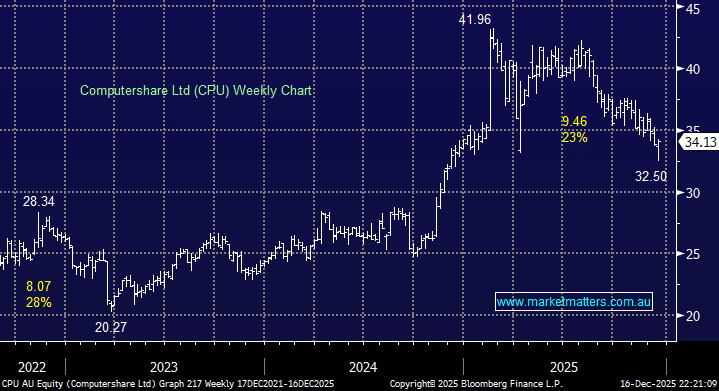

The stock has been weak, down ~23% from its February high, improving the risk/reward in the process. CPU trades on 16x which is a shade cheaper than its usual multiple, however investors shouldn’t hold this stock for growth, it’s more about durability/consistency in earnings and buying it at the right time i.e. when that durability is being underappreciated. With high recurring revenue, long-term client contracts, and essential registry and administration services that are needed in all market conditions, baseline earnings are generally pretty resilient.

However, profits can still fluctuate with interest rates and market activity. Lower rates reduce margin income earned on client cash balances, while weaker equity markets &/or fewer corporate actions reduce transactional and event-driven revenue. There are also added risks of equity market downturns which shrink client balances and employee share plan activity and currency movements, given the company’s earnings are largely US-dollar-denominated.

Distilling this down, we view CPU as more defensive than most financials, but not completely immune to economic cycles.

- We can see good support for CPU around $34, but the very real risk of a Trump puppet heading up the Fed in 2026 is likely to rein in meaningful short-term gains.