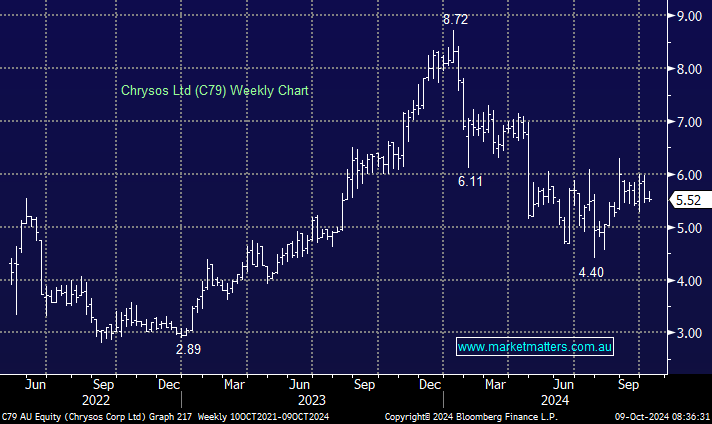

The August FY24 result from Gold testing company Chrysos was solid and slightly beat market expectations, sending the stock higher. As they continue to roll out new testing units, this will drive earnings growth over time. However, the level of growth will be heavily influenced by the deployment schedule, and there are risks to this, particularly in FY25 before FY26 should be a more robust period for them.

The FY25 revenue and earnings (EBITDA) guidance implies modest earnings growth (in absolute terms), before stepping up significantly in FY26. Their recent track record of deployment, though, has us questioning whether or not we’re being compensated for the risks associated with FY25 and how any misstep here would push out the highly anticipated benefits of scale – which would likely have a significant impact on the share price.

The market is optimistic here, with consensus earnings expectations at the high end of company guidance. Their balance sheet remains solid with net cash of $58m and an undrawn CBA facility of $95m, so they have plenty of liquidity at this stage.

- The level of deployment during FY25 is very critical for C79 in the short term, and we are no longer prepared to take the risk around this, given the likely outsized share price impact if they miss again.