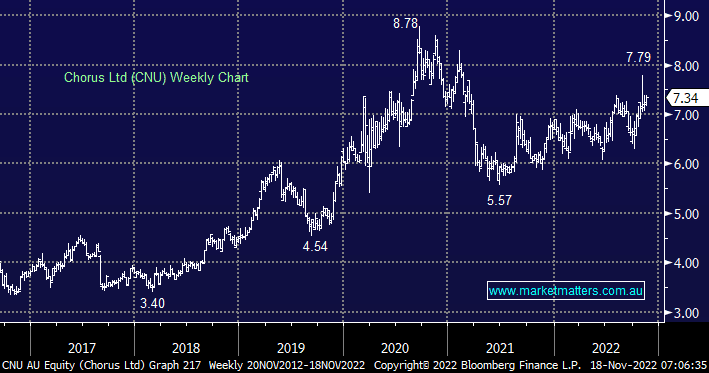

NZ based fixed line infrastructure business does on the surface fit a defensive-orientated portfolio, especially as the shares are forecast to yield over 5% over the next 12 months. However the stock has struggled to keep pace over the last few years and at this stage, we see no catalysts on the horizon to reignite buyers’ interest.

- We believe a KISS (keep it simple stupid) attitude makes more sense at this stage i.e. we prefer TLS, and TPG as an aggressive recovery play.