CLW is a high-quality, defensive income REIT with strong cashflow visibility. We don’t currently own the stock but now see it as a credible option for the Income Portfolio, based on our view that the RBA is more likely to hold rates steady, rather than hike as the market is currently pricing.

For those unfamiliar, WALE (Weighted Average Lease Expiry) is a key property metric measuring the average remaining lease term across a portfolio, weighted by rental income. A higher WALE means leases expire further into the future, providing greater income visibility and lower near-term leasing risk.

CLW’s current WALE is approximately 9.3 years, with portfolio occupancy of around 99.9%. This gives high confidence in future earnings and distributions, with the trust forecast to deliver a 6.3% (unfranked) yield over the next 12 months.

The value of this dividend stream is most sensitive to interest rates. While CLW benefits from CPI-linked or fixed rent escalators that help protect real income, higher interest rates remain a headwind. As a result, CLW often trades more like a long-duration bond, making its price sensitive to changes in bond yields.

Another key valuation input is capitalisation rates (cap rates), which represent the annual return demanded from a property based on its income:

- Cap rate = Net Operating Income ÷ Property Value

For example, a property generating $5m in net income valued on a 5.0% cap rate implies a value of $100m. In a riskier environment, cap rates rise, and property values fall; in more benign conditions, the opposite occurs. Rising bond yields typically place upward pressure on cap rates, something we’ve seen recently as markets priced out rate cuts and began to price in hikes.

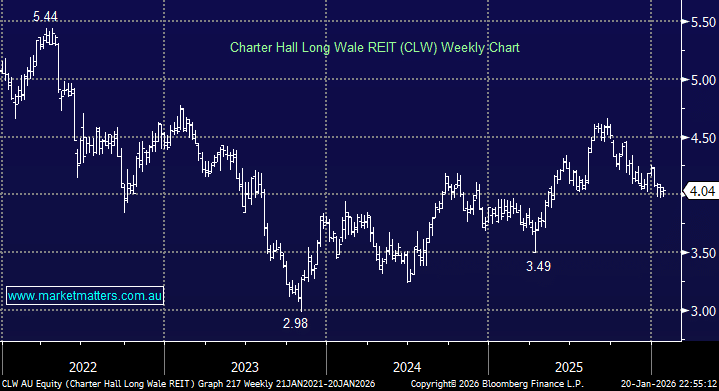

Distilling this down, we believe the market has become too aggressive in pricing further RBA tightening. If the RBA holds rates or adopts less hawkish language, bond yields should ease, making CLW’s 6.3% yield more attractive and supporting a higher unit price, all else equal.

CLW also benefits from a high-quality tenant base, skewed towards government and large corporates, with exposure across office, industrial & logistics, retail, data centres and social infrastructure, spread across 500+ properties. This provides strong diversification and lowers overall portfolio risk.

- For an Income strategy such as ours, CLW offers dependable, contracted income and diversification. Recent share price weakness has brought the stock firmly back onto our radar.