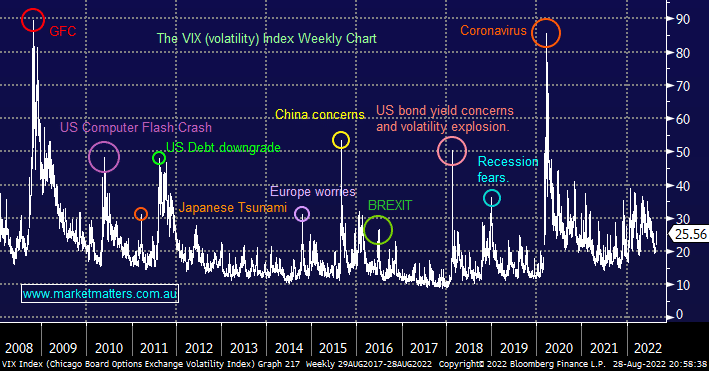

Following a 1000-point plunge by the Dow we would usually expect the VIX to rally far harder than was witnessed on Friday, the move hardly registered on the chart for 2022 which paints a picture that the downside risk to stocks has significantly diminished. Overall we agree with this synopsis believing the current pullback for stocks will present some great buying opportunities into Christmas although as always knowing exactly when to pull the trigger is hard hence we will be scaling our buying into the market.

- The VIX remains way below its last few month’s highs which we believe is largely because investors are underweight stocks i.e. they don’t need to hedge the downside.