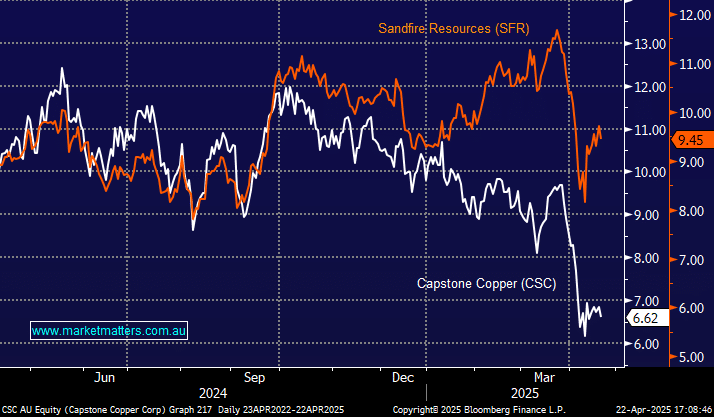

CSC is a large copper (Cu) company based/listed in Canada but remains a relative newbie on the ASX. Theoretically, it’s not a classic EC, but the $5 billion miner has considerable copper exposure, which we like. After halving since its October high, it has caught our attention, especially as it significantly underperformed local favourite Sandfire (SFR). However, it has fared far worse than our current EC holding, AIC Mines (A1M):

- Year-to-date: Sandfire (SFR) +1.8%, AIC Mines (A1M) unchanged and Capstone Copper (CSC) -32%.

The obvious question is whether it is time to switch to CSC or whether we should “Let sleeping dogs lie”—the winning formula for the last 18 months. Canadian companies have been smacked amid US-China trade war concerns. The company has encountered several operational and strategic challenges in 2024, impacting its performance despite achieving record production levels: ramp-up delays and unplanned maintenance led to cash costs remaining higher than anticipated, averaging $2.75 to $2.80 per pound last year. Management is forecasting output to increase by ~15% this year, helping push cash costs down by 15% which all sounds great in theory.

At MM, we remain huge Cu bulls, especially as we expect another leg higher in EV adoption over the coming years. Yesterday, Chinese manufacturing giant CATL unveiled an upgraded battery cell it claims can offer faster charging for electric vehicles than its rival BYD, less than 5 minutes and buyers will really take notice. The world’s biggest EV battery maker said that a new version of its Shenxing flagship battery cell could offer a 520-kilometre range from just five minutes of charging time. Technology for EVS is accelerating, which will improve offerings at reduced prices and increase demand for Cu.

- We see no reason to be a hero towards CSC ahead of its first quarter result on the 1st of May, but there will likely be a time to consider the miner through 2025/6.