Shawn was walking around his local Woolworths store this week and he was surprised to see ~70% of the shoppers were staff basketing orders for online orders – he obviously goes at a quiet time. However, it got the gears turning as to how the large supermarkets will evolve over time as we shop increasingly online with convenience and price being major drivers. Our first thoughts were a comparison with the banks who have changed materially over recent years, and it’s been great for the respective stock prices.

Banks: Following the royal commission in 2018/9, the sector has benefited from fewer branches, reduced staff costs, AI, and a rapid transition to a cashless society.

Supermarkets: There is some clear overlap with the banks, starting with the ACCC’s final report on the sector being handed down in March. Near-term investment in technology such as AI will pressure margins, though if the major domestic players can evolve into more ‘Amazon-style’ businesses, it will ultimately lead to a better customer experience, and costs will decline on scale and efficiency.

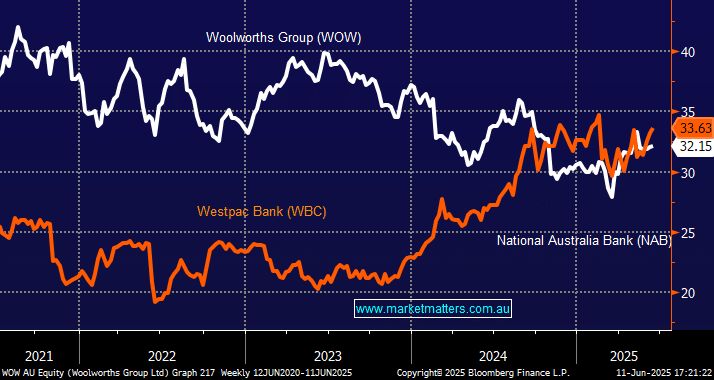

A graph can tell a good story, and over the last three years, Woolworths (WOW) shares have fallen ~20% while Westpac (WBC) has risen over 60% – a huge differential across large-cap “blue chip” stocks. The obvious question we ask now is, can Woolworths (WOW) and Coles (COL) ride their next wave as well as the banks have?

One of our initial light bulb thoughts was who owns the real estate? The banks lease most of their branches which is bad news for the respective landlords; CBA is touted to own 10-15% of its branches whereas the others are more in the 5-10% region. The supermarkets own a touch more with WOW 15-20% and COL 10-15%. If walking the aisles becomes a thing of the past, the sale of these (often large) store premises could free up capital and provide a cash injection for the two supermarket giants over time.

Costs are the focus in our thinking today:

Supermarkets: Staff costs are 40-50% of total operating costs, excluding the costs of goods sold, which equate to ~15% of revenue.

Banks: Staff costs are 40-50% of total operating costs, which equate to 18-20% of revenue due to high skill levels, especially in tech.

The similarities continue, staff for both sectors is a considerable factor in profitability. The supermarkets, in particular, have been under pressure on this front due to minimum wage increases courtesy of the Fair Work Commission and overall staff shortages, resulting in higher costs associated with the use of casual and overtime staff. Hence, it’s no surprise that both companies are pushing hard with their online sales models:

- In FY24, 12.5% of Woolworths’ total sales were via e-commerce and 9.4% of Coles, i.e. Woolies is winning the online race.

The supermarkets have shown their hand, and although generally speaking, e-commerce sales tend to have lower profit margins compared to their traditional in-store sales, the gap has been narrowing over time. Ongoing investments in automation and logistics are helping to improve e-commerce profitability as the online grocery channel scales. Woolworths, for example, expects margin improvements and better contribution to overall profit. This is a case of long-term investment by COL and WOW, taking some short-term pain on investment and margins for long-term gains.

- We believe online shopping is only in its infancy, and once the model is humming, it will be easy for them to expand their offering outside the confines of bricks and mortar walls.

This morning, we’ve revisited the two local supermarket goliaths as the ASX makes new all-time highs.