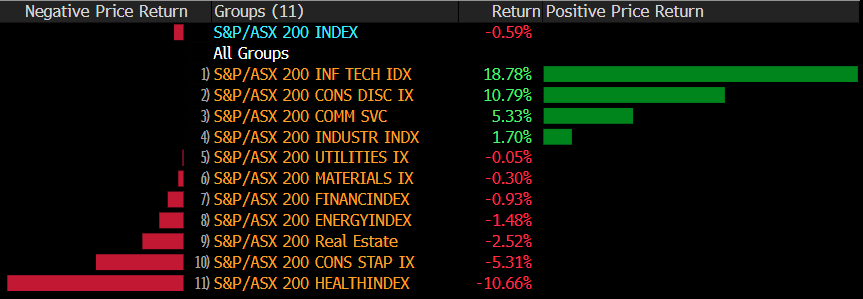

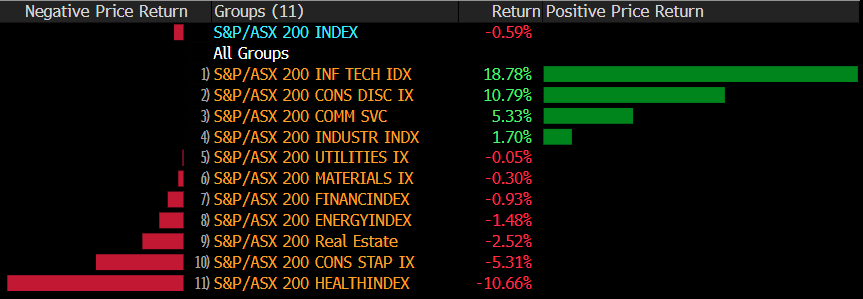

The ASX Healthcare sector has been the main underperformer through 2023, falling over -10%, while the Tech Sector has advanced closer to +20%. There have been some standout laggards in this much-loved sector, with Healius (HLS) and PolyNovo (PNV) down over -30% year-to-date, while only Cochlear and Pro Medicus (PME) have managed to post gains coming into November. Contrarian investors such as Chris Kourtis at Ellerston Capital have started buying names in the battered sector, including ResMed (RMD) and CSL Ltd (CSL) – they certainly look cheap on a historical basis.

- We are looking for some stock/sector performance reversion as bond yields retreat into 2024 – the RBA could easily put a spanner in the works this afternoon.

The correlation between bonds and healthcare stocks has been very clear since COVID-19; as bonds fall/yields rise, the Healthcare Sector struggles. Hence, if we are correct and the Fed’s less hawkish rhetoric last week is the start of a new trend, the Healthcare Sector should enjoy at least a few months in the sun and probably more.

- We are looking for a decent few months for the Healthcare Sector into the New Year – the RBA could slow the process down this afternoon.