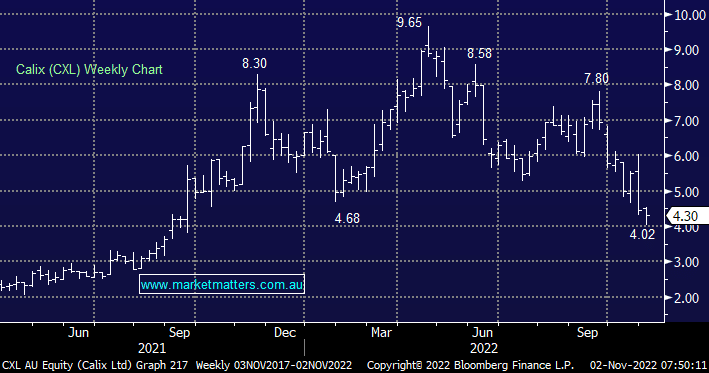

We sat down with management this week after a very volatile October to try and get a gauge of how the company is tracking through the noise. They raised $60m through an institutional placement a few weeks ago at $4.55/sh following a transformative deal with Heidelberg Cement. Calix has already successfully implemented its technology in a trial plant and is working through a scale-up project. The licence agreement and royalty deal sets the terms for Heidelberg to implement Calix’s Leilac technology across all ~150 sites if Heidelberg wishes, but more importantly, the structure of this deal (licencing + ongoing royalties) sets the benchmark for any future agreement Calix takes with other partners, a huge de-risking event in our opinion, particularly given the size and importance of Heidelberg globally.

Shares gave back post-deal strength this week though after it was announced the Australian Government had pulled a total of $41m worth of funding for separate projects CXL had underway with Boral & AdBri. The company was hugely disappointed with the news with the new Government providing little detail around the decision, particularly given it came just a few days after a Federal Budget which promised spending on green initiatives with an explicit focus on Cement. They did hint at a separate funding plan, but Calix was provided little detail on how this comes together.

Despite the news, Calix noted that both Boral & AdBri had firm commitments to reduce carbon emissions by 2030, and will need to act now to hit their targets, with the company confident it remains part of this plan. They also noted the significant global interest, with 60+ projects in the pipeline at various stages, with the total value being many multiples of the lost Government funding.

NB: The Share Purchase Plan is around halfway through the allotted time period, with the price being the lower of the $4.55 placement price or a 2.5% discount to the 5-day volume weighted average price (VWAP) leading up to the close. We will likely participate, however, we will decide nearer the close of the offer and advise subscribers accordingly.