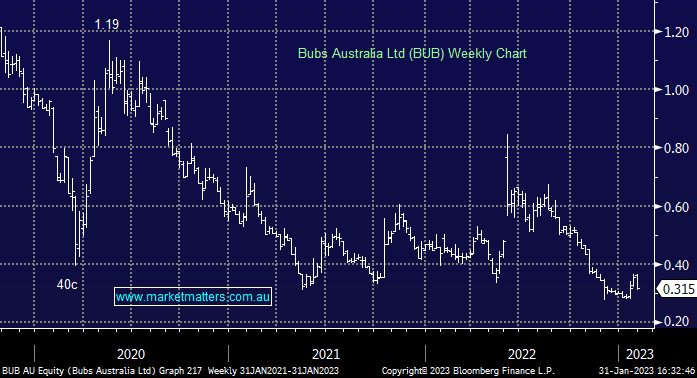

BUB -11.27%: weaker China sales weighed on Bubs shares today, just a week after the stock rallied on the potential upside in China sales. Gross revenue in the quarter was down 28% on last year, weighed by a 66% slump in China sales, though international revenue climbed thanks to the emergency supply agreement signed with the US in the middle of 2022. The weak quarter saw 1H revenue fall 1% on pcp, however, the company was talking up their fortunes for the rest of the year. China sales are expected to rebound as the country opens up again, while Bubs is hopeful of a permanent agreement with the FDA in the US to continue to supply formula into that market.

scroll

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is neutral BUB

Add To Hit List

Related Q&A

BUB & PPS – Value Propositions?

Does MM like the smaller retailers at the moment?

MM view on BUB

Current thoughts on Bubs Australia (BUB)

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.