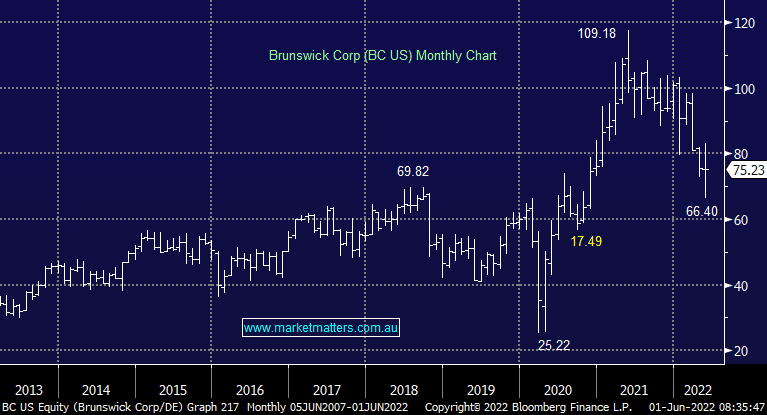

Brunswick is the biggest recreational boating company in the world owning brands like Mercury, Bostan Whaler & Bayliner to mention just a few, however, their reach is significant ranging from propulsion to finance & insurance. We bought BC US about a year ago and the stock has declined since with the position sitting on a ~28% paper loss which begs the question, what should MM do? There are two competing factors at play here, as interest rates rise, consumers have less free cash to spend on discretionary items such as boats, however, rising rates are also positive for the ‘value’ end of town and BC trades on just 7x Est 2022 earnings. Earnings expectations have held up while the market has arguably gotten ahead of the likely impact of rate rises by selling the stock off over the last 12 months. We suspect this could well be a case of sell the rumour, buy the fact, with Brunswick being a very high-quality operator.

scroll

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is bullish & patiently long BC

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.