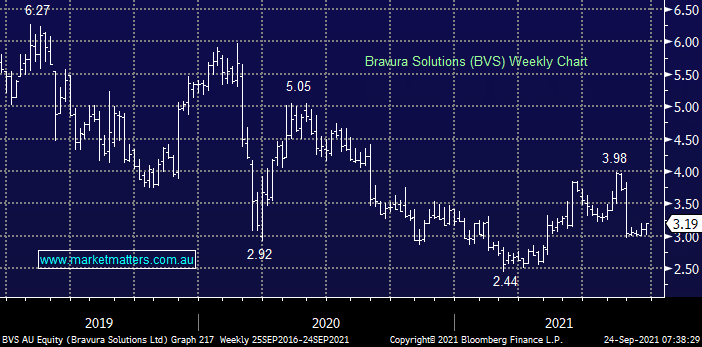

BVS has been a thorn in our IT exposure of late after delivering a disappointing report in late August which was tarnished by weaker guidance and the departure of long term CEO. We believe the sell off has been overdone but as we mentioned earlier this is a sector which rarely returns stocks to favour in a hurry, a bounce back towards the $3.40 area may see us scratch this holding.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is neutral / bullish BVS

Add To Hit List

Related Q&A

Outlook for Bravura BVS

BVS – Bravura Solutions

Health of Bravura (BVS)

Does MM like BVS &/or JEPI?

Does MM have any interest in Bravura (BVS)?

Does MM see merit in “Averaging Down”?

Does like BVS at current levels?

What does MM think of BVS after its savage decline?

Buying Magellan (MFG)

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.