Brambles (BXB) generates revenue primarily through rental and service fees from its global pallet and container-pooling business (mainly under the CHEP brand). Its hard to imagine a business generating $US6.7bn in revenue in FY25 from pallets but obviously there’s a little more to it than the annoying wooden pallets that end up on the driveway every time you get a delivery:

- BXB owns a huge pool of reusable pallets, crates and containers. Customers like supermarkets, manufacturers, logistics companies rent these pallets for moving goods through supply chains.

- They earn rental fees, repositioning / transport fees, and service fees for sorting, inspecting, and repairing these pallets.

This is a highly recurring and predictable revenue stream for BXB who own more than 350 million pallets and containers globally. Companies prefer renting to owning because Brambles handles logistics, repairs, and recovery. The model is “share and reuse”, creating the recurring income with attractive high customer retention.

- BXB’s average pallet varies in size depending on the region where its used enabling it to improve automation compatibility.

- The CHEP pallets (Brambles’ core product) cost roughly $US25-35 per unit depending on lumber and material costs.

The scale and profitability is suddenly very impressive when we extrapolate the numbers across 350 million pallets:

- The estimated life expectancy of a pallet is 7-10 years, the average number of trips in a lifetime is 100-120 with the revenue per cycle ~$US4-6 dropping down to $US18-20 per year.

Hence, BXB makes on average 15-20x its money on each pallet over its lifetime. However, these numbers are obviously impressive but the business is clearly economically sensitive, if we see a recession, less stuff gets shipped and vice versa.

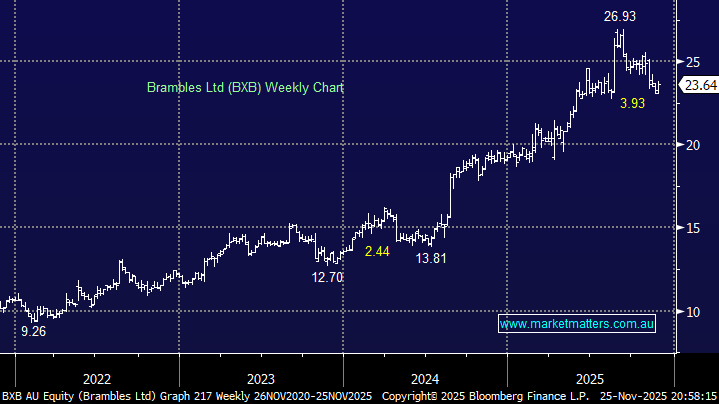

In August, the stock popped to new highs after the company reported FY25 earnings of $0.645 per share, up from $0.558 a year earlier accompanied by a surprisingly bullish FY26 outlook. BXB lifted its dividend and announced a fresh US$400 million on-market share buyback after the global pallet giant met its annual profit guidance despite U.S. economic uncertainty weighing on demand. Encouragingly, BXB, which generates more than half of its global revenue from its Americas division, said that volume headwinds were more than offset by net new business wins, which accelerated through the year demonstrating the increased resilience of the business.

The chart of BXB reminds us of CAR Group, a new addition to the portfolio, and a few other stocks that punched to new highs in August during reporting season only to drift lower as the market rally stalled. The question is what valuation is justified as we head into 2026? Even after the recent almost 15% pullback the stock is trading almost 20% above its average valuation (EV/EBITDA) of the last 5-years, illustrating there’s plenty of good news built into today’s share price.

At this stage we see room for positive surprises if the Fed cuts in December and 2026 proves to be a stable year for the US economy.

- We like the BXB business and it looks good risk/reward below $24 but its rich valuation keeps it from entering our Hitlist for now.