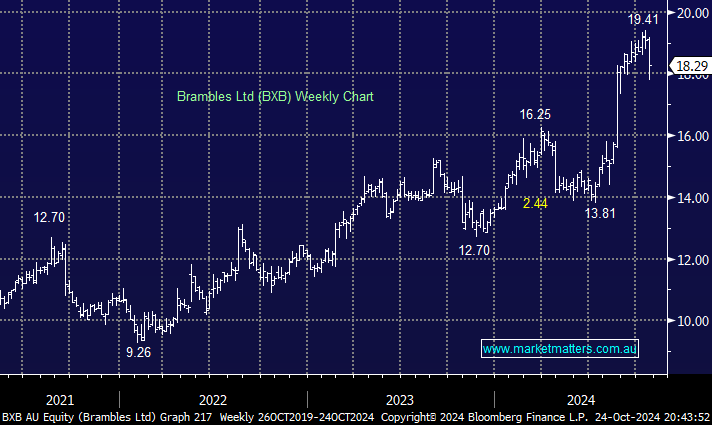

Global pallet giant BXB slipped 1.5% after 1Q24 sales growth came in below expectations, up 3% for the 1Q compared to FY25 guidance of 4-6%, not too bad compared to some we’ve witnessed. Although they did reconfirm FY guidance, there now feels some potential for a miss here and the stock fell accordingly. However, the company delivered a great result in August, including a $US500mn share buyback after reporting a 77% rise in annual free cash flow, and while yesterday’s numbers weren’t great this is a quality company that usually delivers. They did reaffirm FY25 guidance so are expecting an improvement for the balance of the year to hit their stated growth rates – the current weakness is likely to be a buying opportunity.

- We like BXB into current weakness and may add it to our Hitlist.