A very good quarterly update from the world’s largest alternative asset manager overnight, reporting strong fund performance and flows. Assets under management (AUM) of $US1.11 trillion was up +10% YoY and mildly ahead of expectations, split fairly evenly across three key areas of Real-Estate ($325bn), Private Equity ($345bn) and Credit & Insurance ($355bn), though the growth rates in each of these areas were very different. Real-Estate AUM fell 1.9% YoY while Credit & Insurance increased by 22%.

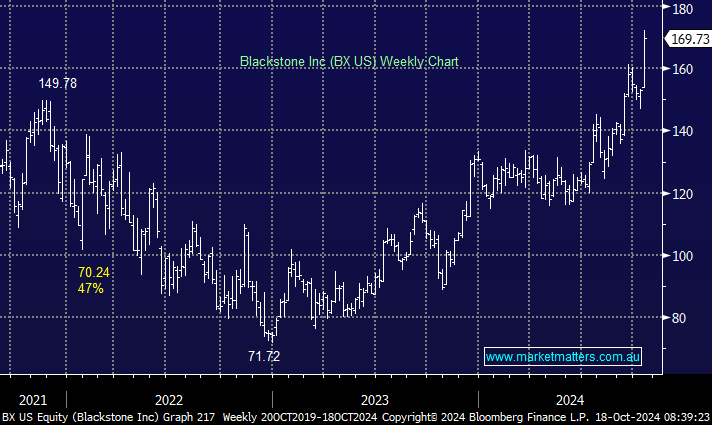

- While BX is performing well over all, propelling the share price to record highs, Real-Estate has been a drag over the past year. However, if you believe the real-estate sector has bottomed, as we do, lower rates and industry dynamics should start boosting performance.

For the quarter, distributable income per share of $1.01 compared well to consensus of 91c, derived from revenue of $2.43bn, with net inflows for the 3-months of $29bn – an impressive number. While economic conditions hold up as they are, and interest rates track lower, this is ideal environment for asset managers, and BX should continue to capture the upswing – we hold BX US in the International Equities Portfolio.