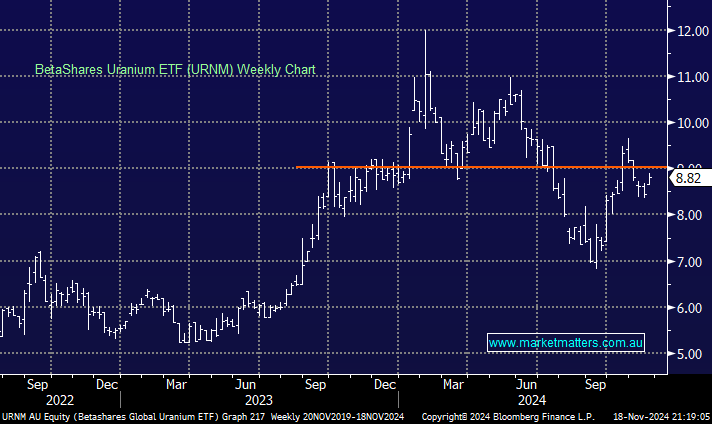

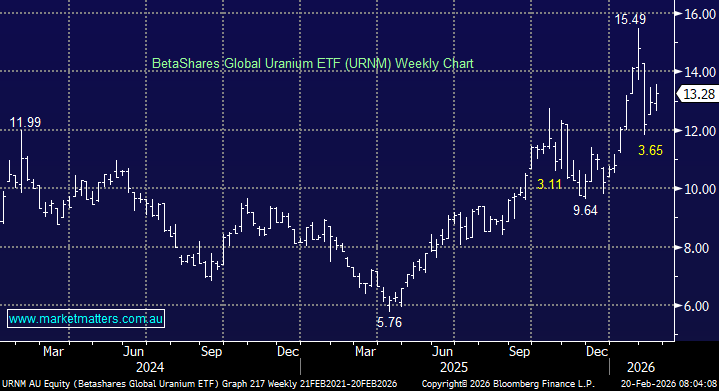

The ASX uranium miners have proven a minefield for local investors. Paladin and Peninsula both announced disappointing production downgrades in the ramp-up period of their respective projects, and the stocks were slammed accordingly. However, while the froth has come out of the broad sector from its panic highs in March, the pullback across ETFs exposed to a global mix of uranium stocks has been far easier to stomach.

- We are bullish on the URNM ETF, initially looking for over +25% upside through 2025.

NB The URNM ETF currently hold 17.55% in Cameco, 13.3% in NAC Kazatomprom, 11.8% in Sprott physical uranium and only 3.2% in Paladin (PDN).