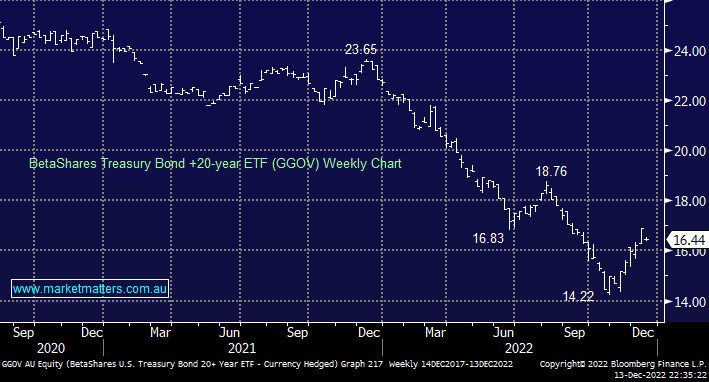

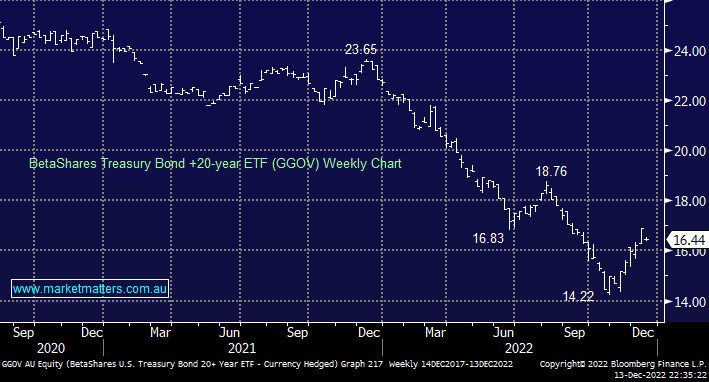

We started to fade bond yields a touch too early across our portfolios but things have slowly started to move in our direction and last night’s market friendly US inflation print has reinforced our view that bonds go higher/yields lower into 2023 i.e. overnight US 2-year yields fell 0.15% to close at 4.22%. While the Feds still lurking in the wings this week we believe it’s time to squeeze the crowded short bond trade.

- We are targeting the $18 area for the GGOV ETF, around 10% above yesterday’s close.