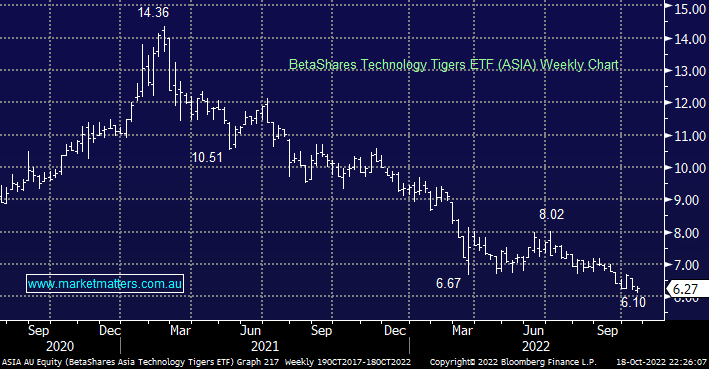

Today we have looked at another of our painful positions, our bullish stance towards Asian tech on relative value grounds has been smacked on 2 fronts, ongoing regulatory controls out of both China & the US plus of course surging bond yields has weighed on the entire global tech sector – we bought after the sector had dipped ~30% but it was clearly still way too soon.

Asian tech stocks have been hit extremely hard and it’s no surprise that the ASIA ETF has followed suit when we look at its top 3 holdings – Alibaba (BABA US), Samsung Electronics (005930 KS) and TenCent Holdings (700 HK). While we anticipate the overall market will help this ETF into Christmas it’s hard to envisage Biden and Xi Jinping resolving their trade differences in a hurry, especially now Taiwan is being actively discussed. Hence this is one of our top positions to cut if / when we see a bounce by global tech into 2023.

- We can see a decent bounce back towards the $8 region in line with a “risk on” theme but we are likely to be looking for areas to exit this position.