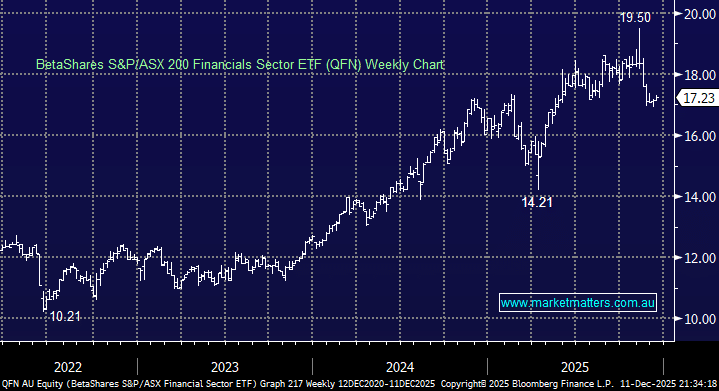

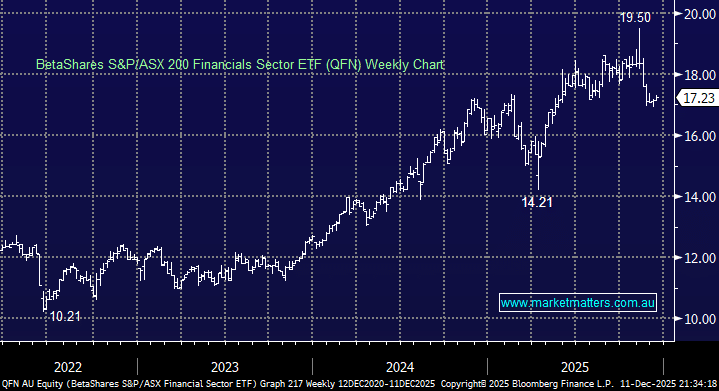

The Financials sector, and this ETF, is dominated by the banks, which make up ~83% of its holdings, followed by the insurance stocks, ~11%. Even though CBA has fallen 22% from its June high, the financial sector managed to punch to a new all-time high in November, led by a sharp move by ANZ and ably supported by NAB and WBC. However, with these three banks having traded ex-dividend last month and interest rates expected to rise in 2026, the attraction to the sector has waned, and the ETF has fallen by ~13%.

Bigger picture, the broad financials sector has enjoyed a strong advance since COVID, but with growth limited for the banks in the coming years, it’s hard to get overly excited about the QFN ETF; we believe better opportunities exist on the stock level within the financials sector. At MM, we are underweight the “Big Four banks”, with the stance likely to be maintained through 2026, hence the QFN isn’t likely to outperform next year.

- We can see the QFN ETF bouncing in the short-term, but a test of this year’s high may take time to unfold.