The QLTY ETF is a $710mn ASX-traded ETF, which is an excellent proxy for gaining exposure to a diverse range of global quality companies. The largest five holdings are Costco, Netflix, Microsoft, Intuit, and Automatic Data Processing, but these five make up less than 11% of the ETF, illustrating its spread of risk across 162 holdings. This ETF incurs a relatively small 0.35% management cost and pays an annual dividend of ~1.4% in June and December. This is a simple and affordable way for investors to get exposure to a diverse range of quality global stocks, with the large broad spread of holdings beyond the reach of many retail investors.

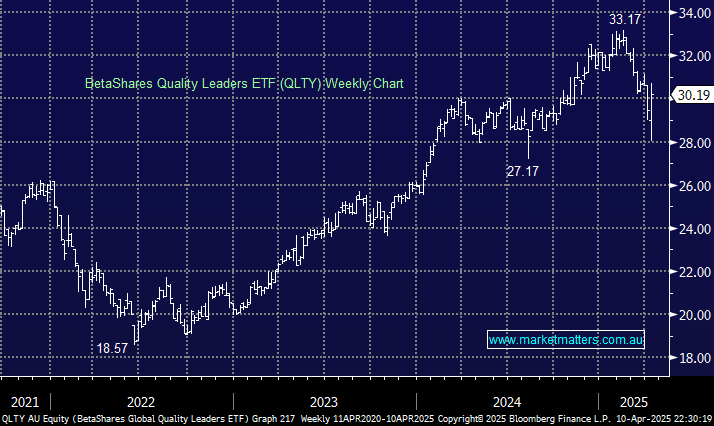

- We like the risk/reward towards the QLTY ETF below $30, i.e. likely this morning.