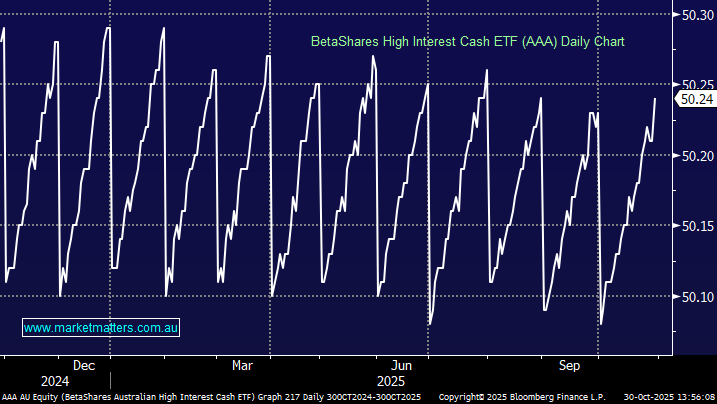

The BetaShares Australian High Interest Cash ETF (AAA) invests in a portfolio of deposit accounts with major Australian banks, aiming to deliver returns in line with the bank bill rate. It provides monthly income distributions and serves as a low-risk, cash-like vehicle for investors seeking capital stability and liquidity.

With its short-duration exposure to cash and term deposits, AAA is well positioned in a rising rate environment—benefiting from higher yields while maintaining minimal capital risk.

The specific objective of the fund is to generate a return that exceeds the 30-day Bank Bill Swap Rate. Its management fee is low at 0.18% for this well-adopted ETF, which currently has a market cap of $4.5bn and has paid a monthly distribution equating to ~4.19% over the past 12 months.

- We believe this is an excellent vehicle to “park” cash between investments, particularly for investors holding cash on investment platforms that pay low returns on cash (as they take a margin).