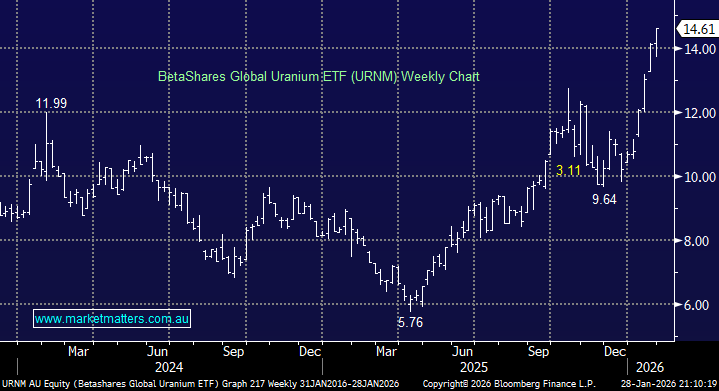

The BetaShares URNMM ETF gives investors broad exposure to the global uranium industry, including mining, exploration, production and firms that hold physical uranium or uranium royalties. Its largest ASX holding is Paladin (PDN) at 5.7%, illustrating its global nature, while Cameco and NAC Kazatomprom remain the prominent holdings, both above 16%, followed by more than 10% in physical uranium. If MM is correct and nuclear power will become one of the pillars of clean energy to fuel the world’s increased demand for power, the last few weeks’ acceleration to the upside could just be the beginning. From a technical perspective, while prices remain above $12.50, we would advocate “buying dips.”

- We believe the advance by the URNM ETF could be in its infancy, with much higher prices likely over the coming years.