The macro picture continues to evolve as expected with US bond yields looking set for a period of consolidation that should allow risk assets to rally further. Our favourite play over the coming few years is long precious metals hence we may increase our exposure into pullbacks over the coming weeks/months.

Gold has been a standout performer through the current banking crisis testing its multi-decade high in the process – while the $US2,000 offers some clear technical resistance we believe it’s a matter of time until we see an explosive breakout on the upside.

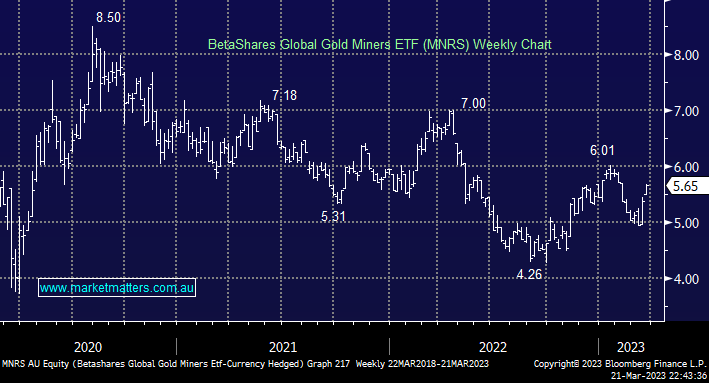

- Our initial target for our MNRS ETF is the $7 area, or +20% higher

- We are considering increasing our exposure to precious metals into pullback and will explore other vehicles over the coming weeks.