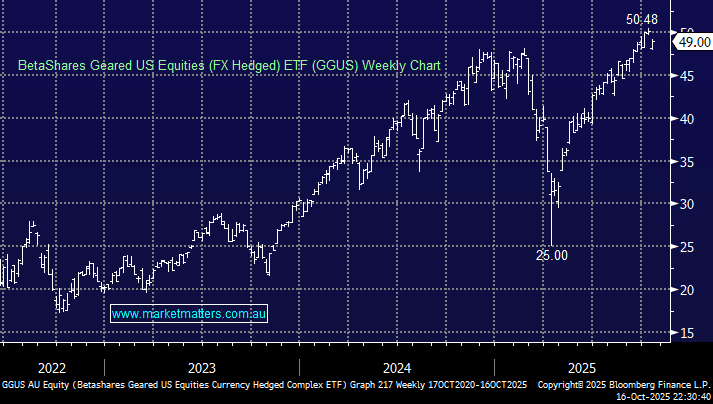

The GGUS ETF, traded on the ASX, is a bullish ETF for leveraged exposure to the broad-based US stock market; the ETF is hedged, so local investors have no exposure to moves in the AUDUSD. Fees are 0.8% pa, while dividends are paid once a year, but they were omitted in 2023 and 2024, i.e. this ETF is not for yield. Like all bullish leveraged ETFs, when the market goes down, the ETF is forced to reduce exposure into weakness to maintain target leverage ratios. The same is true for bearish ETFs when the market rallies, which has the effect of reducing exposure – potentially at the wrong times.

The ETF’s tracking of the US market has been good recently: over the last three months, the US Index rallied 7% while the GGUS ETF has gained 14.3%. However, it should be noted that investors came under pressure when the S&P 500 plunged 21.1% into its April low, and the GGUS ETF fell 48%, illustrating that leveraged ETFs are not for the fainthearted.

- We like the GGUS ETF for a seasonal rally.