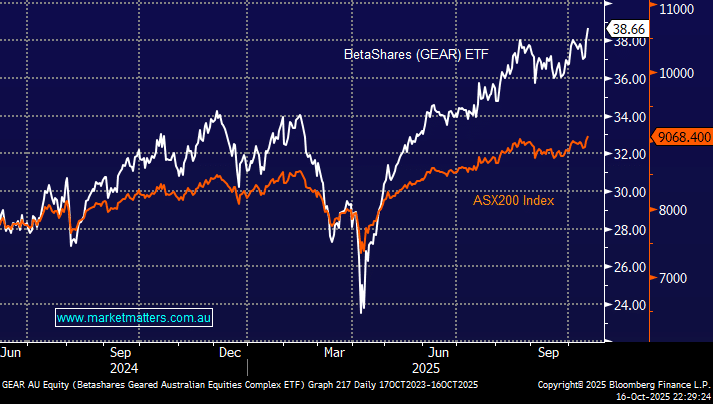

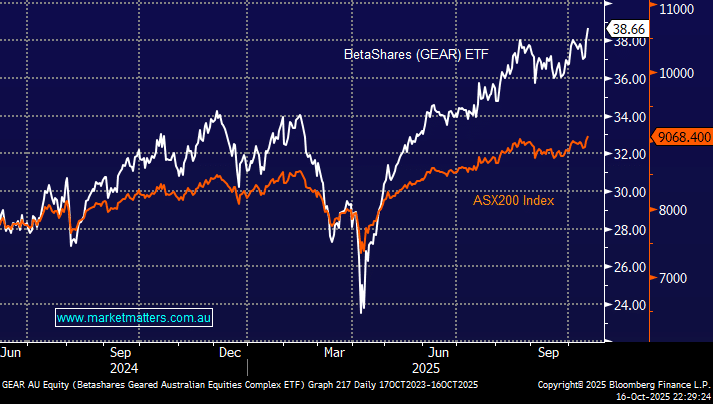

The GEAR ETF, traded on the ASX, is a bullish ETF for leveraged exposure to the ASX200; as would be expected, the five largest holdings are now CBA, BHP, WBC, NAB and ANZ – no CSL at the moment. Fees are 0.8% pa, while dividends are paid twice a year in June and December. However, the GEAR’s real interest is its gearing, which is currently around 2.1x; hence, if the ASX 200 Index goes up 1% today, the ETF would be expected to go up approximately 2.1% before fees and expenses.

The ETF does its job reasonably well over the short term: over the last three months, the ASX200 has rallied 7.5% while the GEAR ETF has gained 13.87%. However, gearing is a two-edged sword, with the GEAR falling much faster than the ASX200 when it experiences periods of weakness. The ETF’s market cap of $558mn compared to the $8.7bn in the A200 ETF illustrates its more active nature, as opposed to being a passive vehicle.

- We like the GEAR ETF to take advantage of a “Santa Rally”.