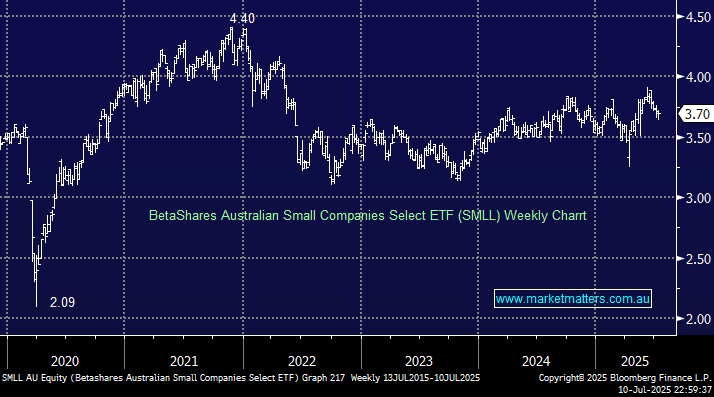

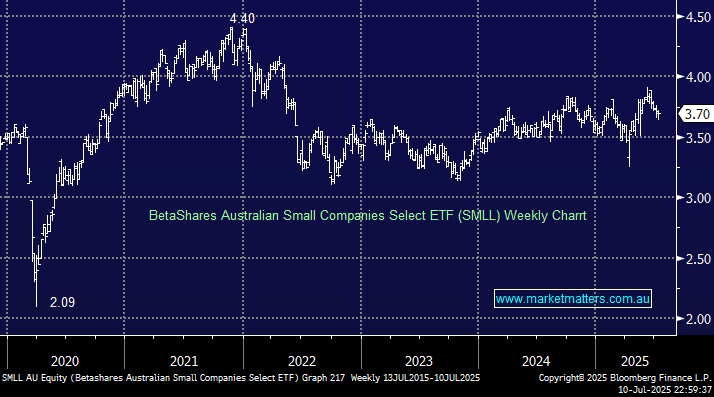

The SMLL ETF seeks to track the return of the Nasdaq Australia Small Cap Select Index (before fees and expenses), which provides exposure to a portfolio of high-quality, profitable small-cap companies listed on the ASX. Of the 70 stocks held, the five largest positions are Perseus Mining (PRU) 4.4%, Metcash (MTS) 3.6%, Ventia Services (VNT) 3.6%, AUB Group (AUB) 3.3%, and Capricorn Metals (CMM) 3.3%, fewer companies than the VSO ETF, with a higher concentration in mining. From a sector perspective, its main weightings are 31% in mining, 12% in REITs, 12% in retail and 8% in Food. If we are correct and the local small caps push to a new high through 2025, this ETF has ~20% upside assuming the underperforming resources participate.

- The SMLL ETF has a relatively small 0.39% expense ratio and tracks its benchmark very well; for example, over the last 3 years, the VSO has advanced by 7.5% while the Nasdaq Australia Small Cap Select Index has gained 7.8%.

The SMLL looks capable of following the MM roadmap into Christmas, testing the 4.50 area, but we reiterate its considerable mining exposure, which has underperformed over recent years, although it is an area we are bullish.

- We are bullish on the SMLL ETF and initially target a test/break of $4.50, or 20% higher.