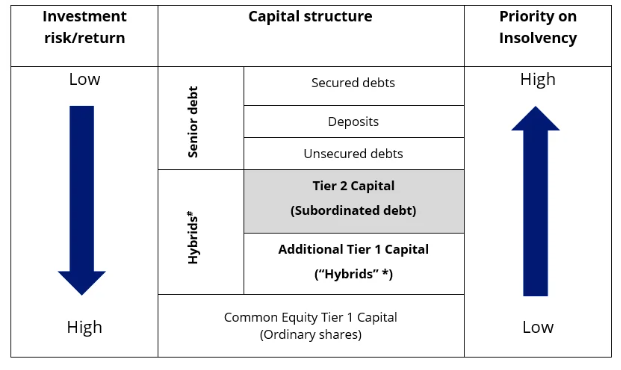

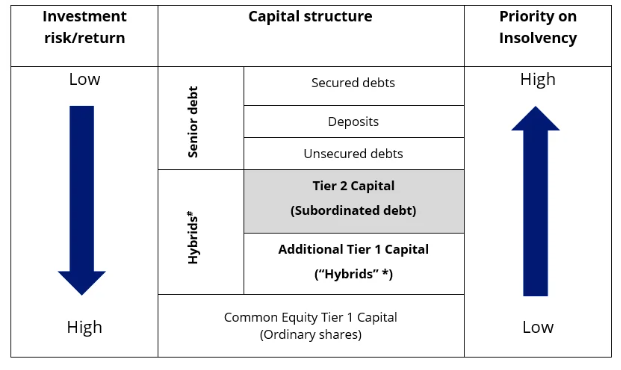

The BSUB is a floating-rate security (rather than fixed) and is probably the closest option to replicate major bank hybrids in the market. The ETF holds subordinated debt issued by the four major Australian banks. Subordinated debt sits above hybrids in the capital structure, but the term subordination means it sits below other secured (senior debt) holders.

Eligible bonds for this ETF must be liquid with at least $500 million on issue and not have a maturity date more than 10 years away. There are some simple benefits of the BSUB:

- Subordinated debt typically pays more than senior debt because they sit lower in the capital structure, meaning they are paid back after senior holders get their money in a wind up.

- In one trade, the BSUB gives exposure to a diversified portfolio of bonds from all four banks.

Subordinated debt exists because regulated banks are required to maintain a certain level of capital buffer to ensure their solvency and stability. Subordinated debt helps banks meet these regulatory requirements. The income paid by floating rate bonds varies in line with a benchmark interest rate. If the benchmark rate increases, so too does the income you receive, and vice versa – the same as hybrids, however, distributions are not franked, with the return being an all cash yield.

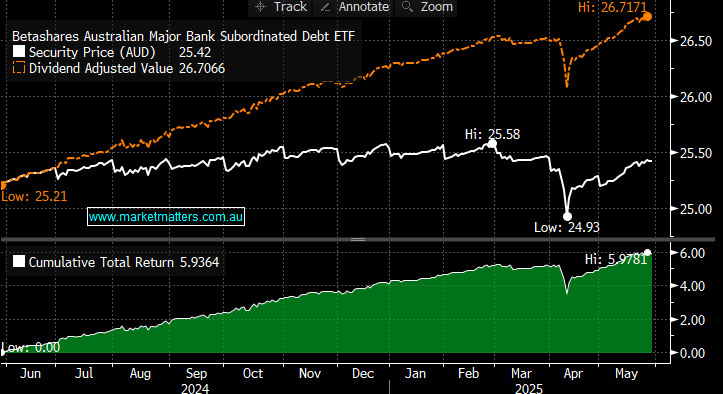

- Advantage: distributions are paid monthly, and while this ETF was only issued in May 2024, the index that it tracks has returned 5.98% for the 12-months, 5.92% pa over 3-years and 4.7% over 5-years. 5-6% is the type of return that this security will provide. The solid credit quality is backed by Australian major banks, and the expense ratio is a low 0.29%.

- Disadvantage: Yield will fall if/when the RBA cuts interest rates.

We think BSUB is a good security for floating rate exposure, though, we have a preference currently for buying fixed rate securities while rates remain high.