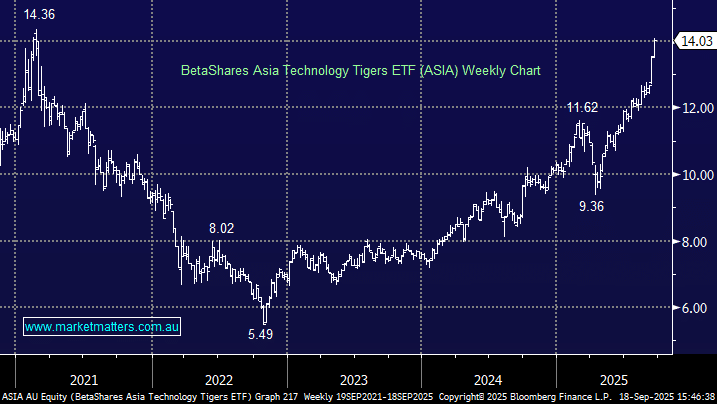

This ETF is the locally traded incumbent in the space, having been listed in 2018, and it aims to track the performance of the Solactive Asia ex-Japan Technology & Internet Tigers Index. The index consists of the top ~50 Asian technology and online retail companies (by free-float market cap), excluding Japan. The ETF has a meaningful market cap of $870mn but is more expensive with an expense ratio of 0.67%.

- The ASIA ETF has 31% exposure to Taiwan, 28% China and 20% South Korea, with its largest 5 holdings currently being Taiwan Semiconductors, Samsung, Alibaba, Tencent, and SK Hynix.

- The ETF has tracked its benchmark well over time: Over the last three years, it has gained +28.31%, while its benchmark is up +29.3%.

This established ETF provides an excellent exposure to Asian tech, holding 56 stocks, including 5% allocations in both India and Singapore.

- We like the ASIA ETF over the coming years, but it’s more broadly based than the DRGN ETF, which is very China-focused.