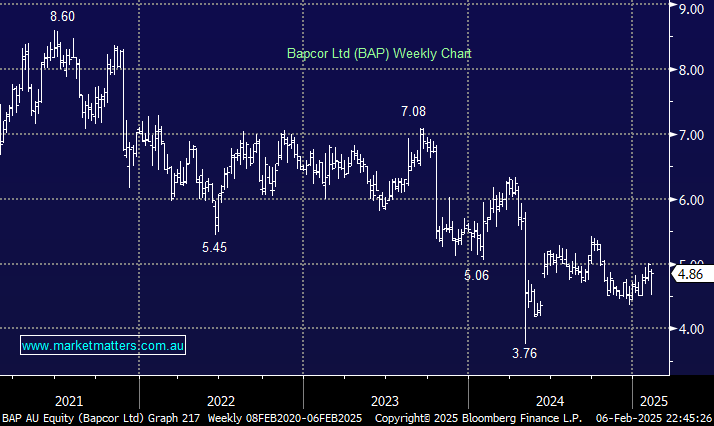

Automotive parts and services company BAP gained +3.2% on Thursday, a distinct laggard finally enjoying some buyers attention. BAP has struggled to regain investors confidence after last May’s earnings downgrade, however, it’s only early days for the new CEO Angus McKay, who took the reins in August 24 as Executive Chair and Chief Executive Officer – he’s very well regarded having overseen significant growth running 7-eleven in Australia over the past 6 years.

That follows a rejected $5.40 takeover bid from Bain Capital in June, they obviously saw a bargain but missed out as the board thinks BAP is worth substantially more. It’s now the job of the new CEO to deliver on that value for shareholders, MM being one of them. As so often happens the stocks continues to hover ~11% below the bid price, but we need to show more patience than that.

We’re awaiting results from BAP on the 26th February, and importantly, a clear road map for what comes next.

- We like BAP initially looking for a retest of $6; MM holds BAP in its Emerging Companies Portfolio.