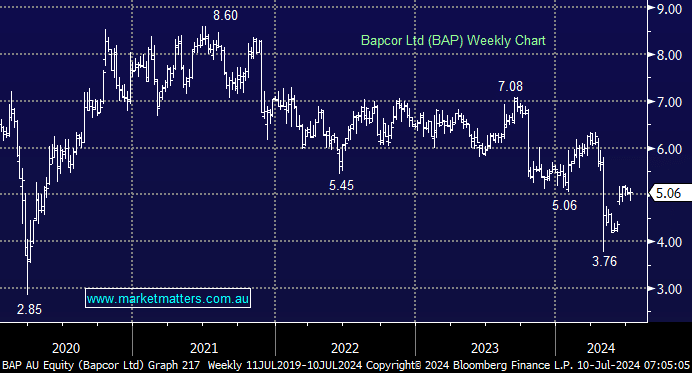

We’re still underwater on BAP, down 11% on our holding, and yesterday they formally rejected an offer from private equity firm Bain Capital to buy the business at $5.40/sh – a bold move given the long list of issues they are dealing with. Bain’s bid was solid, representing 20x consensus 2H24 earnings plus those earnings have some questions around them given the potential for inventory write-downs. The stock held up yesterday for several reasons:

- BAP was already trading at 6% discount to the bid price, implying a level of scepticism

- They reconfirmed profit guidance given in early May, for FY24 net profit after tax (NPAT) to be $93-97m, which tells us that trading conditions have not deteriorated in May-June without a CEO.

- And importantly, they announced a new Executive Chair / CEO – a good one – Angus McKay – who starts on the 22nd August. McKay led 7-Eleven Australia through a period of big change and is well-regarded.

They used the traditional excuse, that the bid undervalues the business, though they didn’t provide any insight on how they would restore that value for shareholders such as MM. That will be a job for the new CEO.

While we agree that selling a business when earnings are low may not make sense, we will be keen to see how the new CEO intends to restore value at BAP – some patience here still feels required.