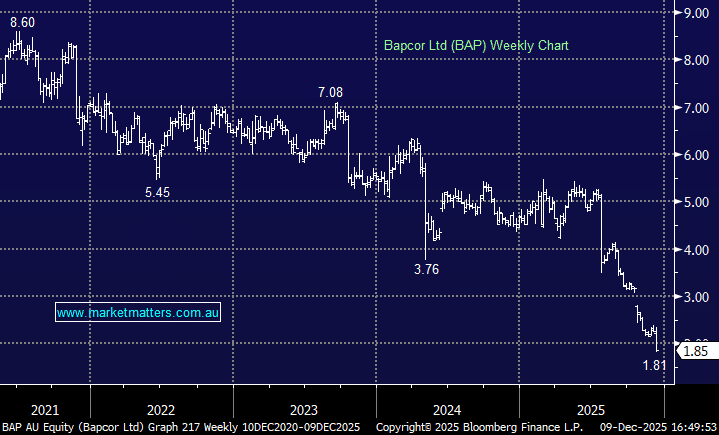

BAP –21.28%: Saw their sharpest fall in over a year, after the auto parts retailer cut FY26 profit guidance and warned of weaker trading conditions, particularly in its Trade division.

The company now expects FY26 NPAT of A$31–36mn, excluding potential impairment charges in its New Zealand operation — a 17% downgrade to previous guidance and well below consensus estimates.

It’s hard to sugarcoat this one – another downgrade, weak trading, and a loss-making first half paint a grim picture. The company remains strategically valuable given its strong retail brands (Autobarn, Burson, Midas, Autopro), but execution continues to disappoint.

We noted just two weeks ago that the stock looked cheap but for good reason, and this update reinforces that view. particularly with Bunnings expanding aggressively into automotive accessories.

- For now, it’s looking like a value trap rather than a value play until management can prove they’re capable of navigating the increasingly competitive environment.