The ASX-traded ATEC ETF aims to track the performance of the ASX Technology Index, with its current five largest holdings comprising Computershare (CPU), Xero (XRO), WiseTech (WTC), CAR Group (CAR), and Pro Medicus (PME), which collectively make up almost 50% of the ETF. This is a good vehicle for gaining exposure to a basket of ASX tech names without incurring extensive specific stock risks, such as the recent ructions at WTC. The fees are 0.48% per annum.

However, while we have been “stalking” an entrance into a couple of ASX Tech names over recent weeks, the issue with this ETF is that around 20% is being held in WTC and REA. Some people no longer want exposure to WTC, like Australian Super, and as we discussed earlier, REA has some hurdles ahead of it; hence, in this instance, we prefer stock selection over the ETF.

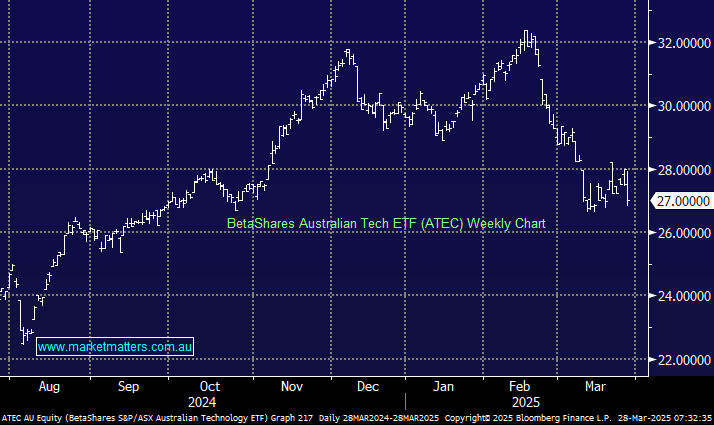

- We like the ATEC ETF with an ideal entry on a dip back toward $26, but it’s not for us.