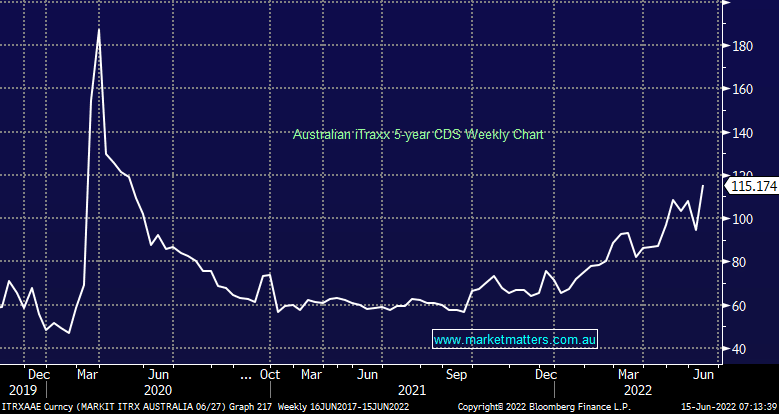

The below chart details the price of the iTraxx, which essentially prices the cost of insuring corporate debt against default. The lower the level, the more comfortable the market is, the higher the level, the less comfortable the market is. It is essentially a proxy for the credit spread of the Australian investment-grade credit (or corporate bond) market as a whole. This is another source of information about how assets are being priced – similar to an equity index i.e. It shows movements and trends and enables bond investors to benchmark portfolio moves versus the broader market. Clearly, the risk of default has gone up which feeds into pricing. i.e. when risks increase, investors want a greater return to compensate. This is what is occurring in the hybrid market – simply a re-pricing of risk, nothing more, nothing less.

During the GFC, this benchmark reached a peak of 443bps. During the height of the pandemic, it traded just below 200. Currently, it is 115 but has been edging higher since December.