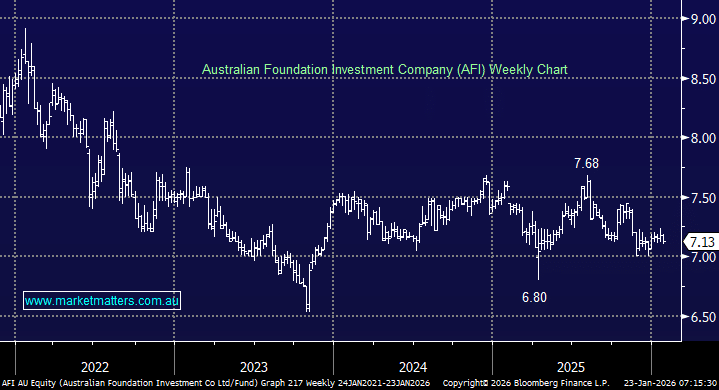

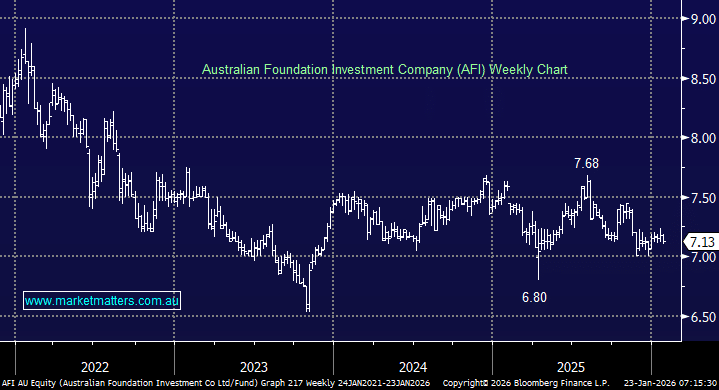

The AFIC LIC has a market cap of $8.9bn, slightly larger than copper stock Sandfire Resources (SFR). This is a long-established, internally managed LIC with a diversified Australian equity portfolio and a strong focus on long-term investing and fully franked dividends. AFIC pays dividends quarterly, yielding ~4.4% over the last 12-months, the equivalent to 6.3% grossed up. As of December 2025, AFIC is trading at a discount of 8.8% to its NTA, i.e. Below the value of its holdings. Over recent decades, AFIC has typically traded at a modest premium to its NTA, averaging around +1.8%. Premiums have tended to widen during periods of low interest rates and strong demand for income-focused investments, with AFIC’s premium peaking at nearly +20% in 2022.

- The Australian Foundation Investment Company (AFIC) fees are very low, at 0.11% of assets, with no performance fees.

Although AFIC holds ~45% of its investments in banks and resources, its correlation to the ASX has been disappointing. Over the 12-months to Dec 25, the portfolio was up ~2%, underperforming the ASX 200 Accumulation Index by 10%,, due to large bets in CSL, James Hardie (JHX), CAR Group (CAR), Reece (REH), ARB Corp (ARB) and Idp Education (IEL) which have all fallen substantially, along with no exposure to gold.

The performance issue has been in play since 2023, lagging the market over the last 3 years, mainly because its value-and income-oriented portfolio has not captured the outsized gains seen in high-growth sectors that have powered the broader market. This is a valid reason, but it also highlights the lack of flexibility within these sorts of strategies. They are so focussed on low activity; they are either very slow or completely reticent to change positioning when conditions change. The Market Matters Income Portfolio for example, has delivered 15.4% over the past year (to Dec 31), also with a value bias and without any exposure to gold.

However, despite recent performance issues, for those believing in the strategy of owning blue chip stocks for the long term, AFIC is interesting, mainly because it’s trading at a meaningful discount to its NTA. If performance improves., history suggests that the discount will close, helping to underpin outsized returns.

- Buying AFI at a ~10% discount makes sense for patient minded long term investors.